Overview

EU open banking APIs are stabilizing and enabling alternative networks: A lesson the U.S. should pay attention to.

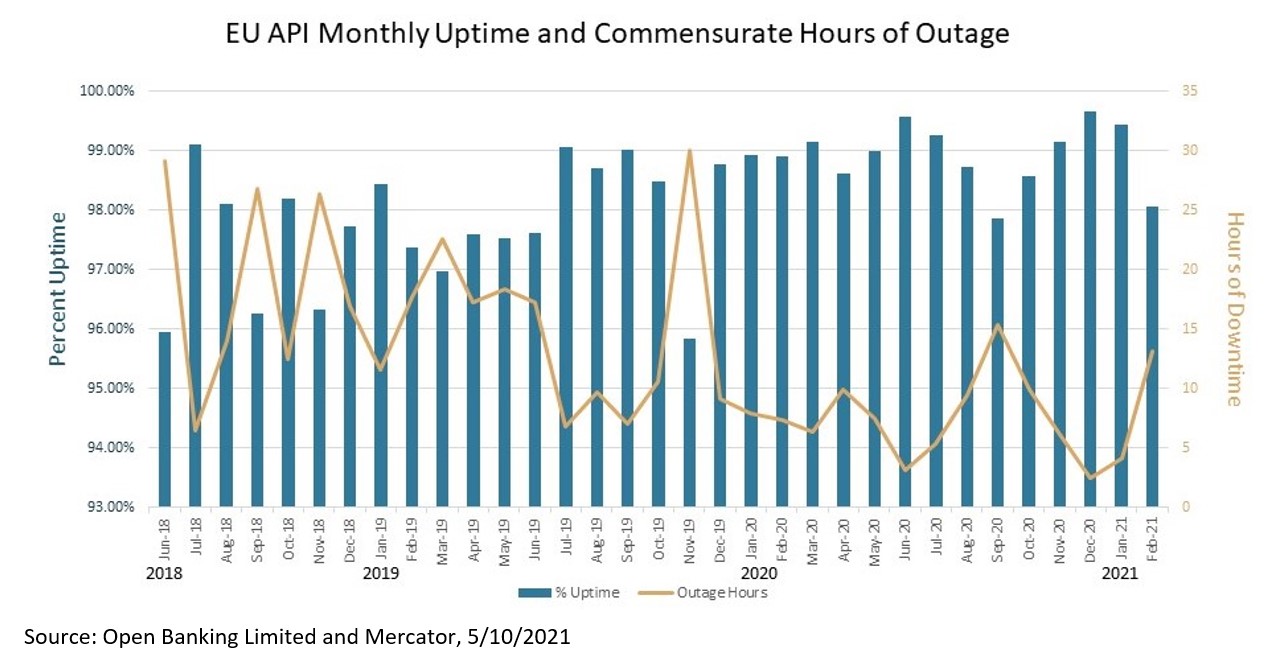

Mercator has studied the gap that exists between the open banking vision of PSD2 and the on-the-ground reality. This knowledge of API limitations can be used to inform any business leader contemplating a similar form of API platform. Mercator Advisory Group’s latest research report, A Lesson for the U.S: How EU Open Banking APIs Have Stabilized to Support Alternative Networks evaluates the issues that have plagued the delivery of Open Banking within the European Union, identifies how fintechs have filled the gap by implementing API middleware, and provides a synopsis of six alternative network solutions that have evolved to leverage the Open Banking APIs.

“It has taken much longer than expected to establish the Open Banking API infrastructure, but the EU is closer than ever to having the concept fully operational. A patchwork of banks are now operational, although many have limited reliability. This points to the cost associated with managing a reliable production-ready API platform. But despite the limitations, several alternative networks have been announced, mostly limited to the UK, which has the most advanced Open Banking infrastructure,” comments Tim Sloane, VP of Payments Innovation and Director of the Emerging Technologies Advisory Service at Mercator Advisory Group and the author of the report. “There are many lessons to be learned out of the hard work that has gone into building the EU Open Banking infrastructure as it exists today, and it would be a terrible mistake to ignore those lessons when building your own API platforms.”

This research report has 26 pages and 4 exhibits.

Companies and other organizations mentioned in this report include: Adyen, Alibaba, Barclaycard, Berlin Group, BMO, BNP Paribas, Cardstream, Competition and Markets Authority (CMA), DNA Payments, Draft Kings, Euro Retail Payments Board (ERPB), European Banking Authority (EBA), Financial Conduct Authority (FCA), FIS, Flywire, GlobalPayments, HSBC,IBM, Ingenico, JPMorganChase, Judopay, Kevin, Marqeta, Mastercard, Microsoft, MIR LTD., Monek, MoneyGram, Mulesoft, NatWest, Open Banking Implementation Entity (OBIE), Open Banking Limited, OpenID Foundation, PayPal, PPRO Financial, SAP, ShieldPay, Shopify, STET, Target instant payments settlement service (TIPS), Tesco Bank, The Banking Industry Architecture Network (BIAN), Token.io, TransferWise, TrueLayer, Trustly, Visa, Worldpay, Yoyo Wallet LTD.

One of the exhibits included in this report:

- A review of the issues that have complicated and delayed the introduction of Open Banking interoperability standards across the EU.

- The standards bodies and regulators attempting to correct these interoperability problems.

- How fintech has created API platforms and middleware that mitigate some of the interoperability problems but do so at a cost for both the implementation effort and performance.

- Identification of the challenges that must be overcome to deploy a production-ready Open Banking platform.

- A perspective on how Open Banking may evolve in the U.S. market.

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world