It’s Not Too Late to Become a Commercial Card Issuer

- Date:February 13, 2014

- Author(s):

- Amy Hoke

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Boston, MA – February 13, 2014 – For banks with a cash management presence but without a commercial card offering, the time is right to enter the market and offer card products for businesses, according to Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service.

Mercator Advisory Group's newest Research Report, It’s Not Too Late to Become a Commercial Card Issuer, shows that offering commercial cards is an excellent way for banks to extend their cash management product set.

"Banks that don’t offer commercial card products run the risk of being disenfranchised from their cash management customers that use card products to manage some or most of their business-to-business payments," comments Amy Hoke, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service. “With the market expected to continue to grow, it’s not too late to become a commercial card issuer.”

The report is 21 pages long and contains 8 exhibits.

Companies mentioned in this report include Santander Bank, N.A., TSYS, and Visa.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

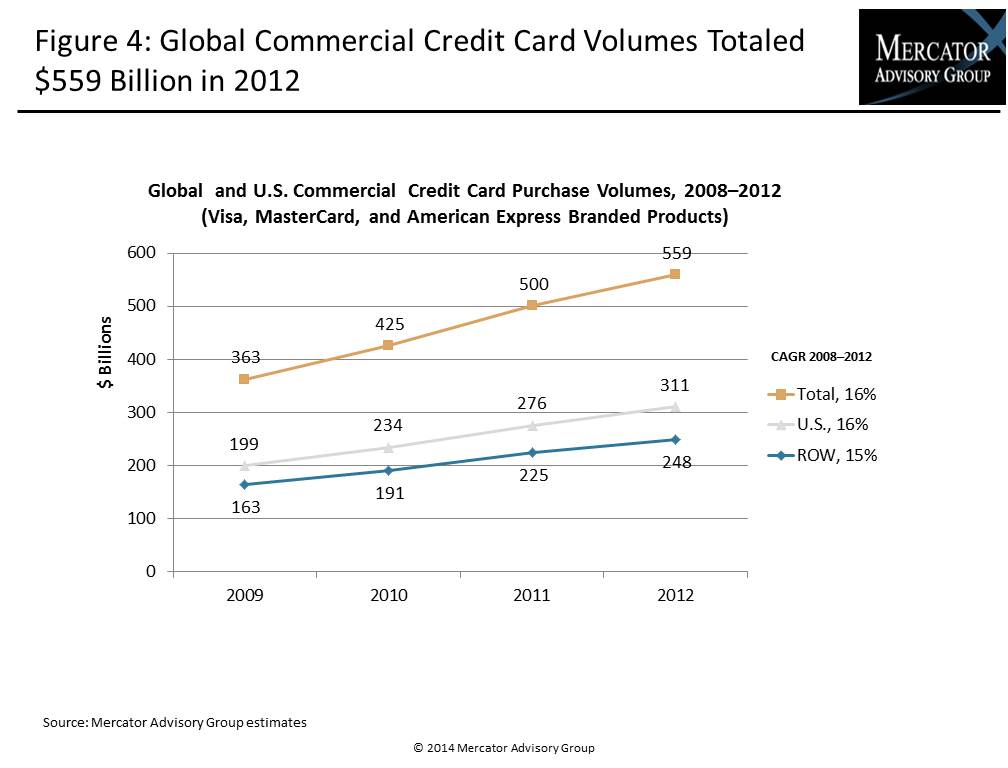

One of the exhibits included in this report:

Highlights of the report include:

- Definition of the types of products offered by commercial card issuers

- Definition of various payment forms for commercial cards

- Description of additional features that make up a commercial card program

- Card volumes and growth

- Issuance models

- Guidelines for new issuers to get started

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world