Overview

Boston, MA

December 2008

IP, Broadband and Dial-up Access: Will Cost Savings Close the IP Deal?

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of its latest report, IP, Broadband and Dial-up Access: Will Cost Savings Close the IP Deal?

Remarkably, while broadband access is available to nearly every US worker and advanced IP device configuration is performed by consumers daily on their home Internet and Wi-Fi gear, merchants continue to rely on dedicated telephone lines to transact payments. This new report examines the barriers, drivers and nuances that continue to drive Level 4 Merchants and their ISOs to choose dial-up point of sale terminals in what is an otherwise all Internet Protocol world.

This report concludes with a discussion of what is required to make the shift to IP and how long dial-up point of sale gear will play a dominant role in the Level 4 merchant POS infrastructure.

Highlights from this report include:

- While broadband Internet access is available to 96.66% of US workers, availability at the merchant POS is essentially a non-issue.

- Dial-up POS terminals represent 85% of the terminal installed base among Level 4 "Mom and Pop" merchants. Top-tier merchants operate over IP-based networks using either private or open Internet links and often both.

- The IP value proposition to "Mom and Pop" has to rely on total cost of ownership, specifically the ability to eliminate the cost of dial-up telephone lines. IP's other advantages remain too abstract to drive demand.

- Compared to dial-up models, an IP Premium of $50 and more exists, layered on top of what has been a similar price bump for internal PED devices.

- Given new low-cost, PCI PED-approved dial-up terminals like the Hypercom T4205, it is expected that by 2013 there will be 1.2 million dial-up POS terminals in use in the United States.

"In this all digital, all the time world, dial-up POS is a tenacious bastion of analog communications. Simplicity, adequacy and custom are powerful forces keeping that digital world at bay," comments George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. " ISOs, processors and merchant level sales organizations are going to have to push hard on the total cost of ownership proposition to convince Mom and Pop that it is time to make use of the broadband Internet connection that they already have. There are enough countervailing forces to suggest that the pushback from payments-weary merchants will remain strong."

Companies mentioned in this report include Hypercom, VeriFone, Ingenico, Nurit, First Data, and Exadigm.

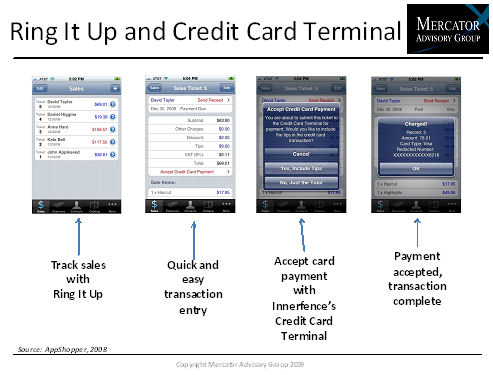

One of the 9 Figures included in this report:

The report is 24 pages long and contains 9 exhibits and 1 table.

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world