Overview

Rapidly expanding international prepaid market creates new opportunities.

Mercator Advisory Group’s most recent report reveals some of the most important trends within the global prepaid market.

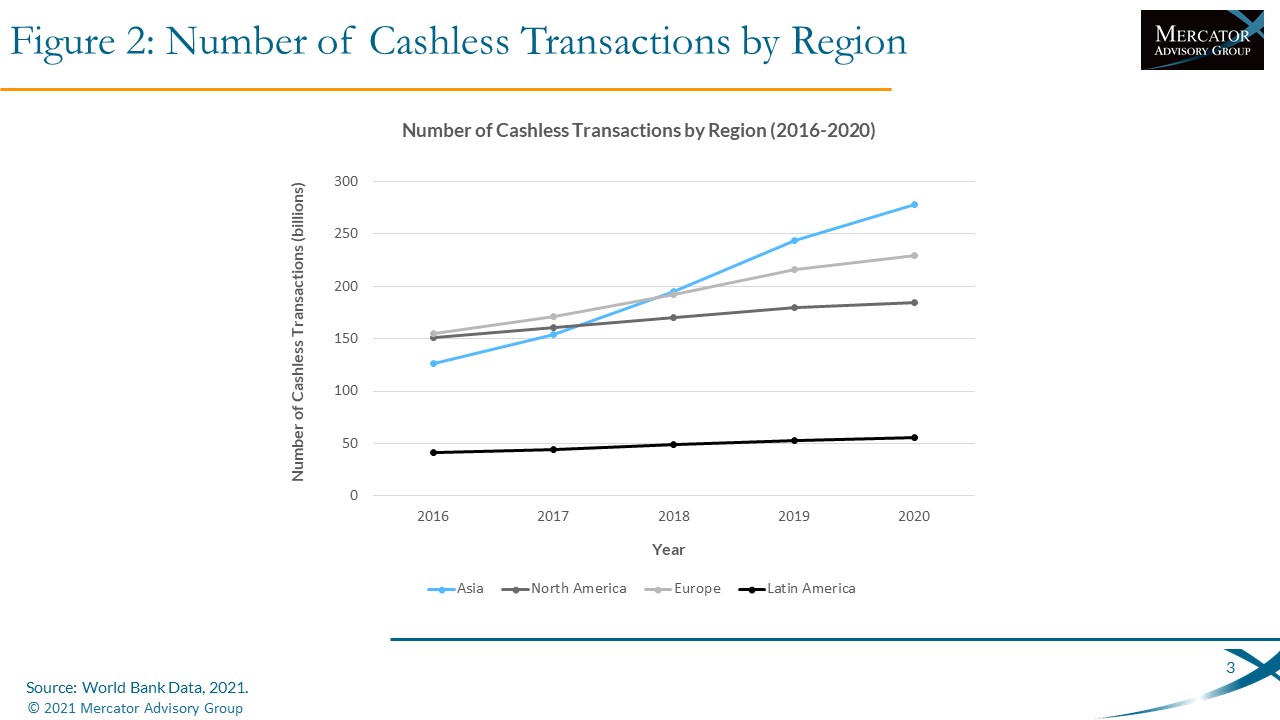

The international market is booming, but it is not expanding at the same rate everywhere. In emerging markets in Latin America and Asia, where consumers have more limited access to other forms of cashless payments, prepaid cards serve an important role in daily life. As e-commerce and demand for non-cash payment types rises in these regions, prepaid cards are experiencing profound growth.

On the other hand, in regions where prepaid markets are well established—namely Europe and North America—legislators are cracking down on fraud associated with prepaid cards. New regulations may threaten the growth of prepaid card markets in these regions.

Across all regions, prepaid card markets have found new use cases in recent times and there is a great deal more growth to be had within the market.

“The prepaid market is witnessing sustained and significant growth throughout the world, with an average estimated CAGR of 13% through the year 2023. As e-commerce spreads globally and demand grows for cashless payment methods, prepaid cards stand to benefit. Government initiatives in support of transitions to cashless payments are numerous,” states Laura Handly, analyst at Mercator Advisory Group, and the author of the report.

This report is 15 pages long and contains five exhibits.

Companies mentioned in this report include:

American Express, Coinbase, Crypto.com, GiveDirectly, Global Payments/TSYS, Green Dot Corporation, HSBC Holdings, JP Morgan Chase, Mastercard, Visa

One of the exhibits included in this report:

- A review of trends within the global market

- An examination of trends within the market by region

- An exploration of innovative global use cases for prepaid

- Predictions for the future

- Recommendations for issuers of prepaid cards

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world