Overview

Mercator Advisory Group’s latest research report, International Money Transfers: Simpler, Digital, and Cheaper, looks at the international wire and remittance business and the market forces that are shaping its growth.

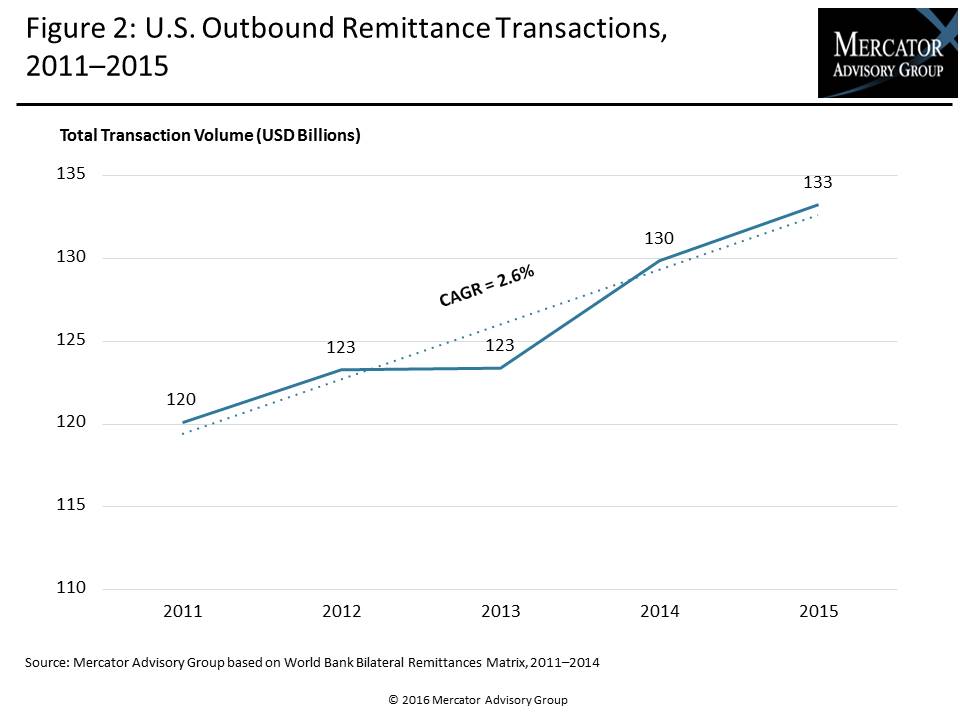

“Trillions of dollars leave the U.S. in the form of an international wire or remittance. That number has experienced steady growth. Market growth, the magnitude of the flow of funds, the opportunities that result from the pervasiveness of smartphone and internet access, plus the fragmentation of market providers have made this form of payment open to innovation ,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This report is 18 pages long and has 7 exhibits.

Companies mentioned in this document include: Android, Apple, Bank of America, CFPB, Citi Bank, clearXchange, Facebook, J P Morgan Chase, LinkedIn, MoneyGram, Remitly, Ria, Samsung, SWIFT, TransferWise, Travelex, Venmo, Wells Fargo, Western Union, and Xoom.

One of the exhibits included in this report:

- Understanding the fundamental characteristics of wires and remittances

- Use cases for international money transfers

- Market participants including new fintech providers

- Causes of the downward pressure on pricing

- Impact of U.S. regulation

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world