Industry Segmentation: Identifying High Value Niche Opportunities

- Date:May 18, 2008

- Author(s):

- Mercator Research

- Research Topic(s):

- Digital Banking

- PAID CONTENT

Overview

Boston, MA

May 2008

Industry Segmentation: Identifying High Value Niche Opportunities

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report from Mercator Advisory Group's Corporate Banking Practice talks about the importance of industry segmentation, especially for finding unique high value market niches.

Today's economy and competitive environment requires bank marketers to define their target markets and to tailor product services, and messages to meet the specific needs of those targeted customers. Large national banks use industry segmentation to parse American businesses into their industry categories and then monitor economic trends affecting those specific cohorts. Market segmentation drills down to specifically focus on identifying, within those business verticals, B2B buyer needs, purchasing preferences and marketing leverages industry segmentation, market segment information and insights into the significant variables that define the broader competitive landscape.

Major fortune 500 corporations use industry segmentation to measure market penetration and make strategic adjustments. Banks need to take time to examine businesses in their footprint and evaluate their customer penetration. Industry segmentation takes time and money and many large corporations have fulltime resources committed to this important function. This report provides simple proven concepts used by corporate leaders that can easily transfer to bankers and produce insightful results.

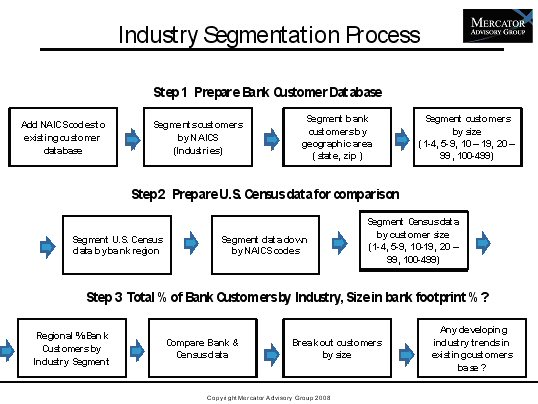

The process begins by organizing a banks existing customer database by NAICS (North American Industry Classification) codes. The benefit of doing this first step is the U.S. government agencies over the last five years have converted their SIC (Standard Industry Classification) codes to the newer more detail NAICS codes. Most banks are in the process of converting from SIC to NAICS codes. Using these new codes banks can link customer information with U.S. Census data or look at the U.S. Bureau of Labor data to create an industry composite. For example banks can determine what percent of a specific industry is represented by their customer base.

To help banks broaden their industry perspective and align with their market strategies this report identifies what other interesting things banks are offering in industry niche markets and how well they are doing. Some banks have successfully tailored industry specific programs to meet the needs of their customers. Banks like Wells Fargo contribute some of their success to an industry focused business strategy. Industry segmentation helps attract and retain customers, boosts profits and strengthens customer relationships.

Understanding a market and developing a niche strategy can be very profitable. Banks need to better understand industry specific trends and needs to capture more market share. Customers are attracted to solutions that meet their needs and there are many choices to select from.

Sarsha Adrian, Senior Research Analyst in Mercator Advisory Group's Corporate Banking practice and author of this report, comments, "This is the first of a series of reports that will put corporate banking and small business banking perspective. Corporate banking is changing. Corporate banking product managers need to recognize the huge potential selling through existing relationships. Bank corporate relationship can be extended to reach new business markets and banks can play a strategic role in their business customers' future."

Book a Meeting with the Author

Related content

What Lenders Can Learn from Fintech Chatbots

Javelin’s diagnostic analysis of AI-powered consumer-facing chatbots for 11 fintechs, non-bank lenders, and retail banks found that retail FIs consistently fail to provide personal...

The Invoicing Gap: How Small Businesses Get Paid, and Why Banks Are Missing Out

Invoicing is one of the most fundamental workflows in running a small business, sitting at the center of getting paid, managing cash flow, and maintaining customer relationships. Y...

How to Make Bank Websites a Better Place to Learn, Shop, and Buy

Javelin Strategy & Research’s analysis of online public websites for five leading FIs—Ally, Bank of America, Chase, Chime, and U.S. Bank—indicates that shopping for a financial pro...

Make informed decisions in a digital financial world