How Canadian Banks Can Close the Gap in Digital Account Opening

- Date:January 30, 2020

- Author(s):

- Tyler Brown

- Report Details: 18 pages, 8 graphics

- Research Topic(s):

- Digital Banking

- Mobile & Online Banking

- PAID CONTENT

Overview

Digital account opening isn’t meeting its potential in Canada, where too few consumers apply for their checking accounts entirely through digital channels. Many applicants continue coming to the branch, the highest-cost channel, to fulfill their account-opening needs. That is even though their day-to-day habits show they readily rely on online and mobile banking. Javelin has identified strategies for digital account opening and features that can help banks reduce costs, decrease abandonment, engage prospective customers, and initiate sticky relationships.

Key questions discussed in this report:

- Which channels do consumers use when they open checking accounts?

- How does digital account opening in Canada compare with the United States?

- Why do some applicants favor the branch over digital channels?

- Why should banks favor digital account opening?

- What can FIs do to improve the digital account-opening experience?

Companies Mentioned: Bank of America, BMO, Chase, CIBC, Citi, Desjardins, National Bank of Canada, PNC, RBC, Scotiabank, TD Bank, TD Canada, U.S. Bank, Wells Fargo

Methodology

Consumer Surveys

- A random-sample panel of 4,280 Canadian consumers conducted online in January 2019. The margin of error is +/-1.50% at the 95% confidence level. The margin of error is higher for questions answered by subsegments.

- A random-sample panel of 11,448 U.S. consumers conducted online in April 2019. The margin of error is ± 0.92% at the 95% confidence level. The margin of error is higher for questions answered by subsegments.

- A random-sample panel of 10,375 U.S. consumers conducted online in June 2018. The margin of error is ± 0.96% at the 95% confidence level. The margin of error is higher for questions answered by subsegments.

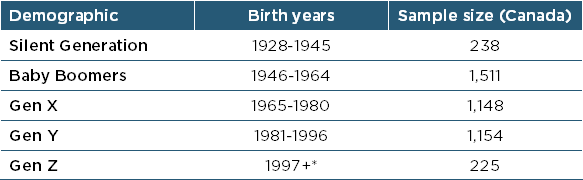

Javelin defines the generations by five segments:

*Javelin’s surveys are limited to adults.

Digital Scorecards

- A quantitative analysis of the availability of more than 400 total mobile and online banking features—including 90 related to digital account opening—at Canada’s top seven FIs by assets. Data was collected from December 2018 to January 2019.

- A quantitative analysis of the availability of more than 400 total features in mobile and online banking at the top 25 U.S. consumer FIs by assets. Data was collected in April 2019. Data included in this report uses the top seven FIs.

Book a Meeting with the Author

Related content

What Lenders Can Learn from Fintech Chatbots

Javelin’s diagnostic analysis of AI-powered consumer-facing chatbots for 11 fintechs, non-bank lenders, and retail banks found that retail FIs consistently fail to provide personal...

The Invoicing Gap: How Small Businesses Get Paid, and Why Banks Are Missing Out

Invoicing is one of the most fundamental workflows in running a small business, sitting at the center of getting paid, managing cash flow, and maintaining customer relationships. Y...

How to Make Bank Websites a Better Place to Learn, Shop, and Buy

Javelin Strategy & Research’s analysis of online public websites for five leading FIs—Ally, Bank of America, Chase, Chime, and U.S. Bank—indicates that shopping for a financial pro...

Make informed decisions in a digital financial world