Overview

How to Build a Better Production-Ready Banking API Portal

Mercator Advisory Group’s latest research report, How to Build a Production-Ready Banking API Portal and Avoid EU Mistakes, identifies the key issues that have delayed the deployment of the PSD2 Open Banking mandated API sets and compiles performance data that highlights the challenges. The report then breaks the challenges down into issues related to technologies versus issues related to standards implementation. Finally, the report identifies the three core functional areas that establish a robust API portal and then rates 12 suppliers against key criteria that make up the three functional areas. The suppliers considered are: Axway, Cloud Elements, FIS Global, Fiserv, IBM, Informatica, Jitterbit, Microsoft, MuleSoft, Software AG, TIBCO, and Token.io.

This report provides all the information required to understand why Europe has had so much trouble implementing the PSD2 mandate and how to evaluate a financial institution’s existing IT infrastructure to determine the API management platform that will fit well into existing infrastructure without duplicating key functions already operating effectively.

“Financial institutions have already made significant investments in data management and data sharing technologies, and most API management solutions duplicate some aspects of that infrastructure,” comments Tim Sloane, Research Director at Mercator Advisory Group, and the author of the report. “Understanding what services are already available enables the selection of an API management platform that utilizes the technology you already have and adds all of the critical functions you need.”

This research report has 28 pages and 6 exhibits.

Companies and other organizations mentioned in this report include:

AIIA, Axway, Cloud Elements, Early Warning, Finicity, FIS Global, Fiserv, Fujitsu, IBM, Informatica, Jitterbit, LexiNexis, Mastercard, Microsoft, MuleSoft, NACHA, NoName Security, OFX, Oracle, Phixius, Plaid, Postman, Salt, SAP, Slack, Software AG, The Financial Services Information Sharing and Analysis Center (FS-ISAC), TIBCO, Tink, Token.io.

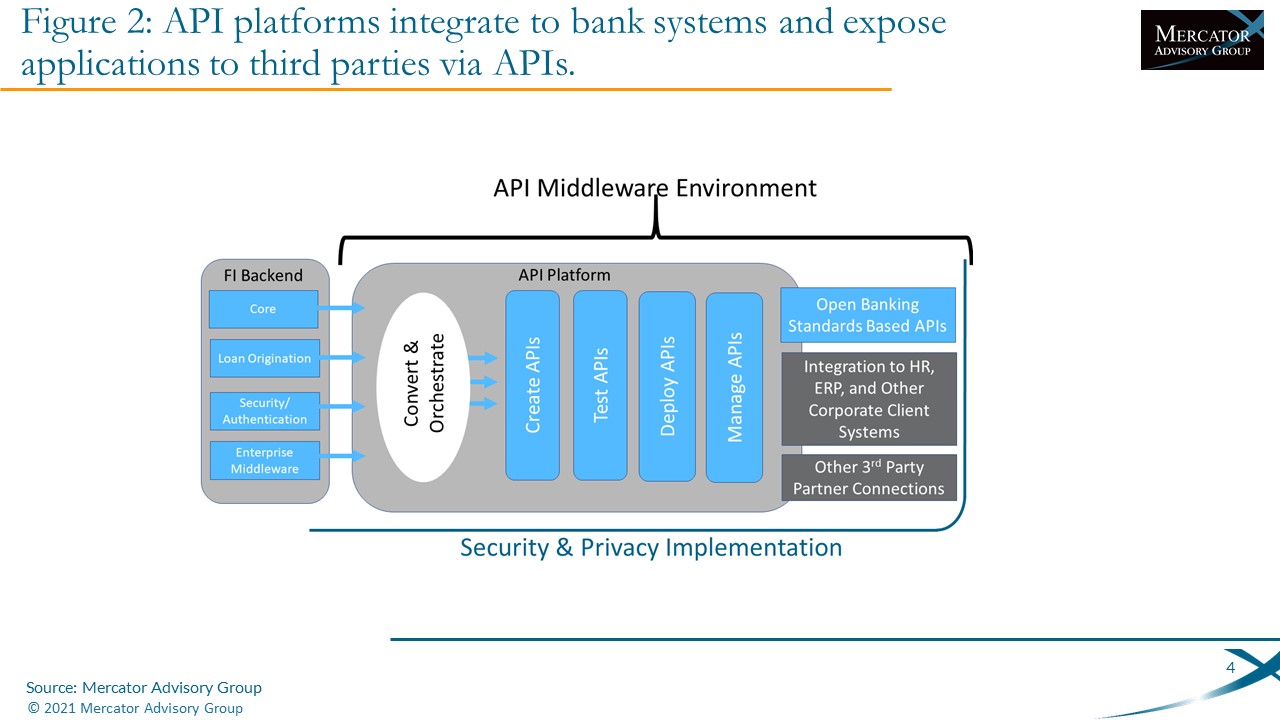

One of the exhibits included in this report:

- A review of the technology, performance, and standards-related issues that have delayed the deployment of Open Banking in Europe.

- A table that labels key issues as belonging to either standards-related problems or technology-related problems.

- A review of key delivery models, from on-premise to cloud and aggregation models.

- An architectural overview of key functions, from internal host integration and data management to the core API management function and the API connectors that are available to connect to external systems.

- A review of the 12 suppliers against different criteria in the three functional areas described above.

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world