Overview

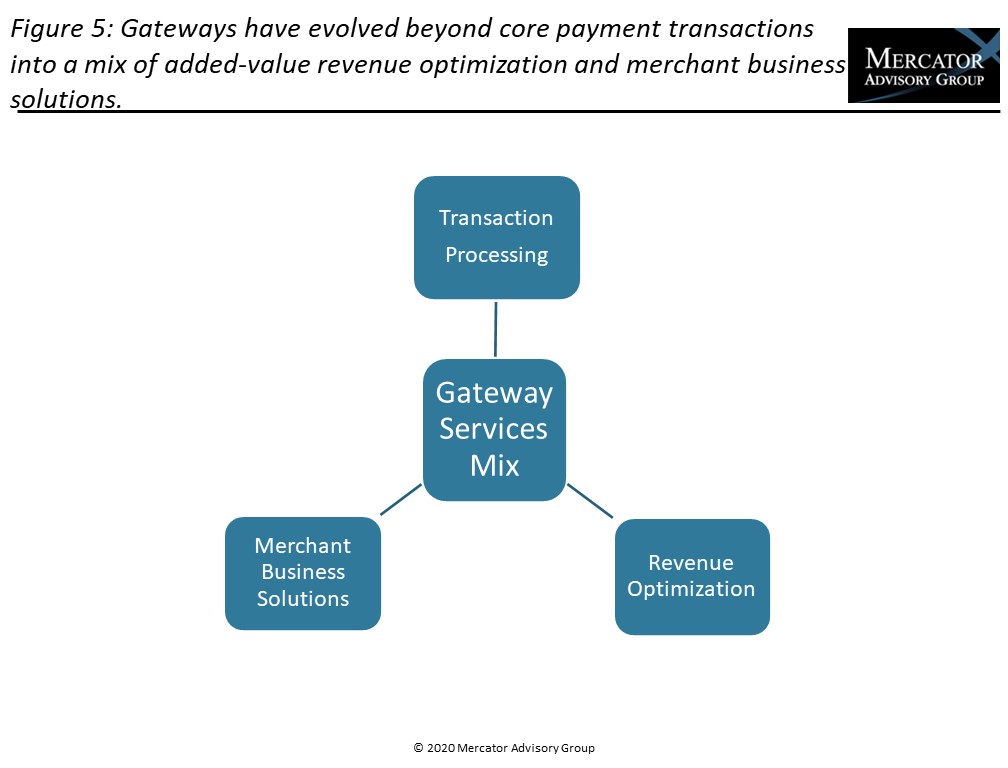

Payment gateways are the fastest growing part of the payments industry’s value chain and have become disruptive forces that in some instances supplant legacy payments players such as merchant acquirers and processors. Payment gateways are a high growth and an intensely competitive category within the U.S. payments industry, offering both core and added-value services aimed at both consumer and B2B online merchants. A new research report from Mercator Advisory Group, Gateways Become Rising Force in U.S. Payments Industry, Part 1: A Market Overview, provides analysis and insight on the current state of the U.S. payments gateway market, supported by a Mercator Advisory Group e-commerce sales data forecast.

“E-commerce has been the driving force in the rise of payment gateways. These firms are lean and nimble, with the DNA of fintechs. Gateways serve online merchants, enabling them to accept card payments across borders and in multiple currencies for both consumers and B2B. With a crowded field of competing gateways, merchants face a daunting task of choosing from this large vendor category that serves the U.S. market with an ever-expanding array of payment solutions,” commented Raymond Pucci, Director, Merchant Services Practice at Mercator Advisory Group, the author of this report.

This report is 19 pages long and has 8 exhibits.

Companies and other organizations mentioned in this report: 2Checkout, ACI Worldwide, Adyen, AEVI, Authorize.Net, Bambora, BluePay, BlueSnap, Bolt, Braintree, CardConnect, Checkout.com, Converge, Cybersource, Elevon, FIS, Fiserv, Global Payments, Ingenico, JPMorgan Chase, Mastercard, Paysafe, Spreedly, Stripe, WePay, TSYS, US Bank, Visa, Worldpay

One of the exhibits included in this report:

Highlights of this research report include:

- How gateways have become an essential payments vendor category

- Mercator market data forecast for retail and travel e-commerce

- Gateways that compete in the U.S. market

- Contrasting paths of 2020 e-commerce sales categories due to Covid-19

- Assessment framework for merchants considering gateway payment solutions

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world