Overview

Fixing the Payments Maze: The Payment Hub Solution

New Mercator Advisory Group report documents how competition in the retail and wholesale payments is heating up and why financial institutions are looking at payment hubs to reduce costs and increase agility

Boston, MA -- Payments businesses are facing increased competition and rapid change in an industry traditionally characterized by slow moving, regulated change. As this report was being published, two leading payments vendors, S1 and Fundtech, agreed to merge and ACI Worldwide made a counter offer to acquire S1 for $540 million. This type of strategic positioning is a prime example of the rapidly evolving landscape.

Over the past decade, payments have taken on new parameters, forms, and services, while financial institutions face new competition from non-regulated players, who are capturing more of the high profit portions of the value chain leaving commodity players out in the cold.

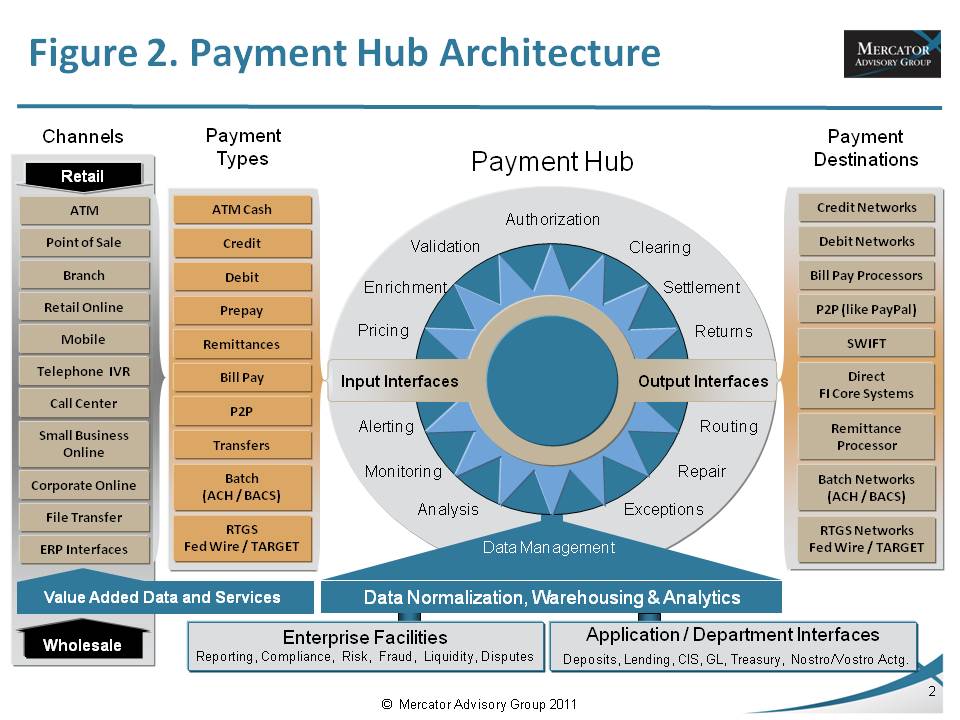

Mercator Advisory Group's new report Fixing the Payments Maze: The Payment Hub Solution reviews the forces driving change in payments and discusses how banks can reduce costs while improving agility by implementing a payment hub strategy. The report defines a payment hub, discusses the critical features of a payment hub, and details how banks can begin implementing an integrated solution. Product roadmaps that lead to a comprehensive payment hub solution from ACI and S1 are examined to provide a template for how institutions can proceed.

Highlights of this report include:

Review of the payment trends and challenges that financial institutions face in navigating the payments maze.

Discussion of payment hub benefits and alternative implementation strategies.

Review of S1's payment hub strategy.

Review of ACI's Agile Payment strategy.

"Payment hubs have been discussed for over a decade with the focus on high value corporate/wholesale payments," states Bob Landry, Vice President Mercator Advisory Group's Banking Group. "In this report we decided to broaden the scope to include both retail and wholesale payments because the lines between the two are blurring and new SOA-based technologies allow innovative institutions to leverage common processing workflows to introduce new products and services in record time."

One of seven exhibits in this report:

This report is 24 pages long and has seven exhibits.

Companies mentioned in this report include: ACI, Fundtech, and S1.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Make informed decisions in a digital financial world