Fighting Commercial Card Fraud and Bridging the Information Gap

- Date:November 24, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

A reality of the payments world is that fraud is increasingly prevalent and so must be the efforts to combat fraud. For commercial card programs, these efforts require a strategic balance among the stakeholders: the issuers, the companies, their employee cardholders, and solution providers. While commercial card fraud may not be in the headlines as much as fraud in other segments of the market, it is still a reality with many unique nuances that require attention.

Mercator Advisory Group's newest report, Fighting Commercial Card Fraud and Bridging the Information Gap, looks at the current state of commercial card activities relating to fraud and many of the opportunities for the stakeholders to build a collaborative approach to address both current and potential threats.

"Commercial cards have always had unique challenges to manage fraud,” comments Richard Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Corporates with card programs have a variety of fraud tools to leverage, but they require strong levels of education from issuers and networks to become more comfortable using them. Fraud activities follow the money, and the complexity of commercial payments from invoice to payment requires diligence and understanding for potential weaknesses in the system.”

The note is 22 pages long and contains 5 exhibits.

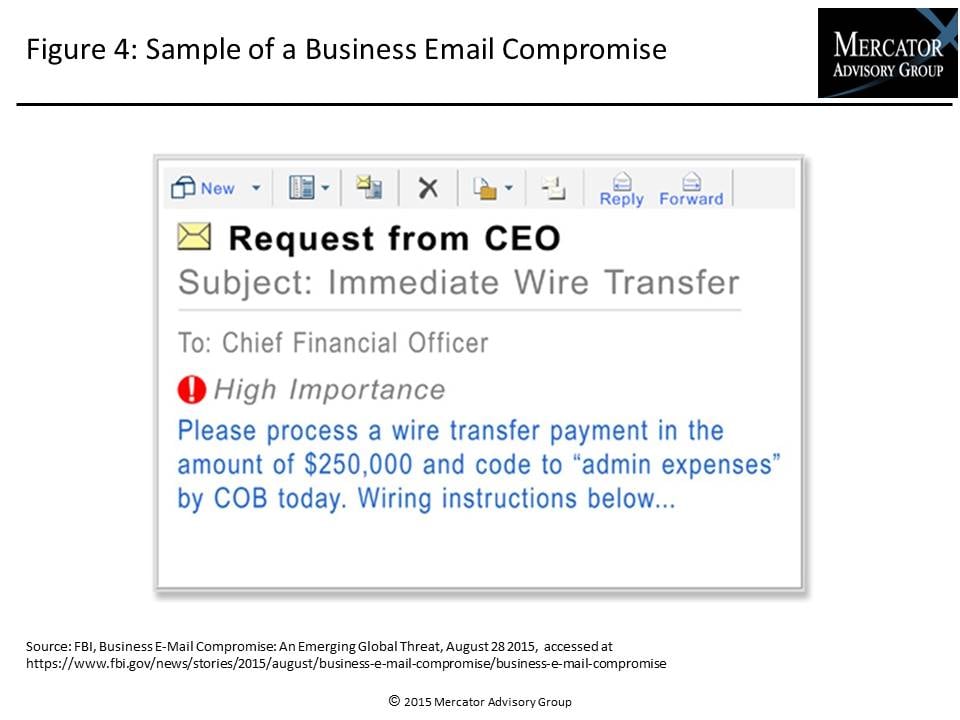

One of the exhibits included in this report:

Highlights of the report include:

- Fraud prevalence, losses and liability

- External fraud tactics and trends

- Prevention and protection from providers

- Technology for corporate card programs

- The importance of corporate and commercial card issuer relationships

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world