Faster Payments: Developments and Challenges for U.S. Commercial Payments

- Date:March 02, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

As expected, 2015 is the year when faster payments in the United States (a.k.a. “real-time payments”) may get the kick start needed to move from an idea to a reality. With the recent release of the Federal Reserve’s position paper and the ongoing development of proprietary solutions in market, momentum appears to be building.

Mercator Advisory Group's research note, Faster Payments: Developments and Challenges for U.S. Commercial Payments, examines the recent developments to advance faster payments in the United States, some of the key stakeholders, and challenges to progress that exist.

"Everyone has been expecting movement on “real-time” or faster payments to pick this year. That the Fed only recently outlined its perspective is positive, but it is very early to get a read on what will happen next,” comments Richard Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “There are significant opportunities to remove friction from the current system, but there are also critical items such as leadership structure and mandates that are unclear, making the market feel a little like the Wild West.”

The note is 10 pages long and contains 3 exhibits.

Organizations mentioned in this research note include ACI, clearXchange, Dwolla, FIS, Fiserv, NACHA, the Remittance Coalition, and TCH.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

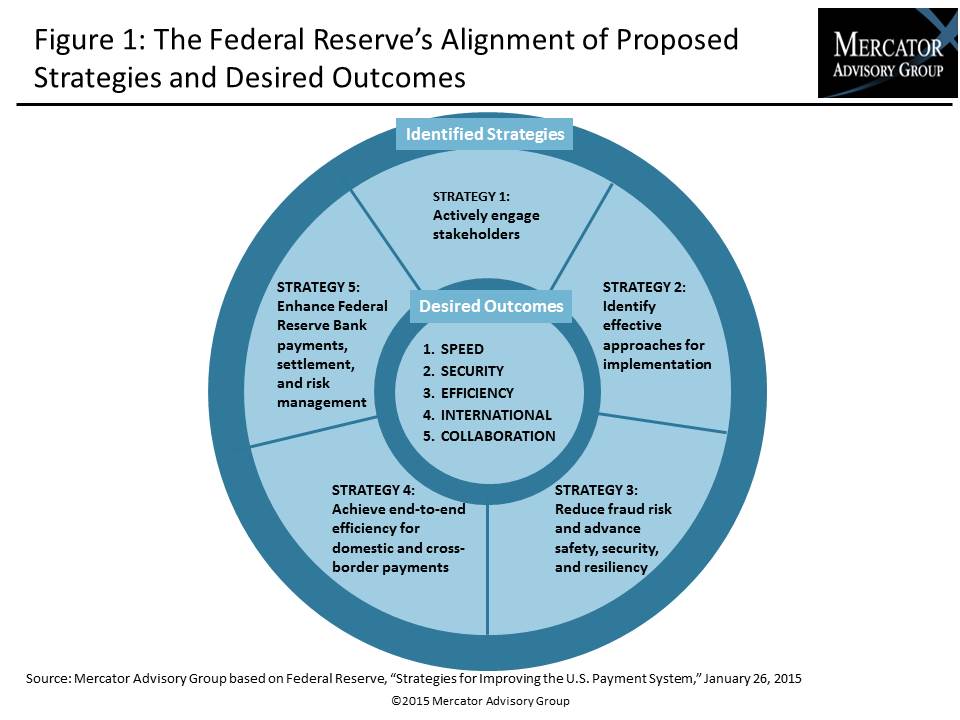

One of the exhibits included in this report:

Highlights of the research note include:

- Recent developments from the Federal Reserve, NACHA, and the Remittance Coalition

- Providers that have developed proprietary faster payment solutions

- Challenges to the proposed timelines and structure for U.S. faster payments

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world