Overview

The complex prepaid market could face disruption with a change in Reg. II of the Dodd-Frank Act.

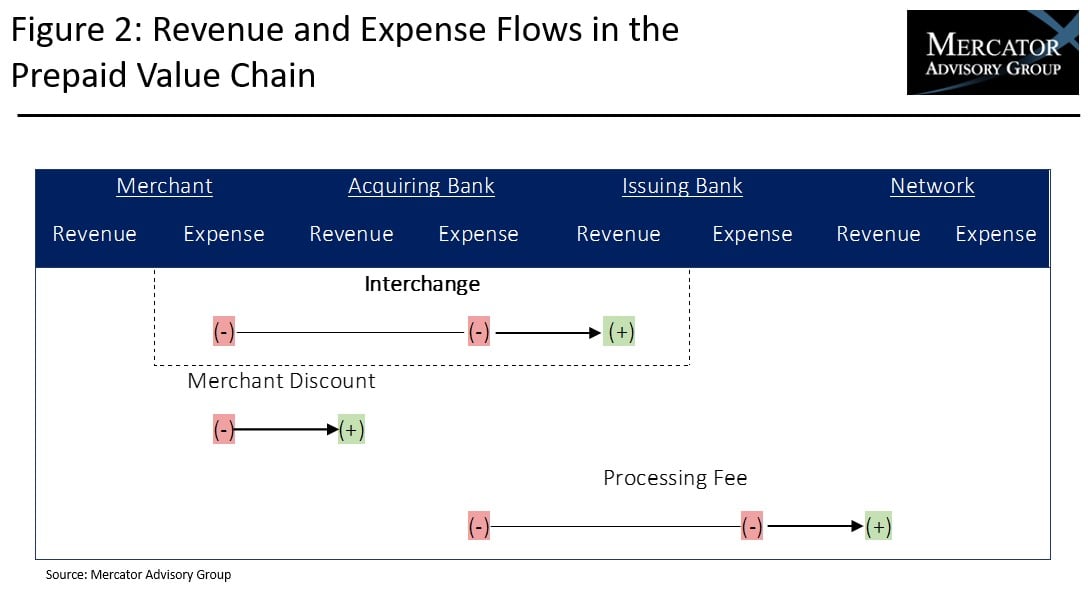

Revenue from interchange fees makes up a large share of many fintechs’ income, but a letter from The Clearing House (TCH) to the Federal Reserve Board may change regulations and cost fintechs much of this profit. The prepaid value chain is made up of a complex web of players, with some benefitting more from interchange revenues than others. Mercator Advisory Group’s latest research report, An Exploration of the Complex Prepaid Market and How a Change in Reg. II Could Unravel Fintechs, discusses TCH’s letter and its possible implications – intended and otherwise – on the prepaid market.

“In effect, answers to the TCH’s FAQs could dramatically transform the prepaid market. While fintechs would lose a significant amount of interchange revenue – often one of their key income-generating activities – traditional financial institutions who have never benefitted from this revenue would gain a competitive advantage. Smaller fintechs and companies that partner with small issuers would also benefit from their larger fintech competitors’ reduced interchange revenue,” wrote James O’Brien and Laura Handly, market research analysts at Mercator Advisory Group and authors of the report.

This report has 11 pages and 4 exhibits.

Companies mentioned in this report include: Bancorp, PayPal, Robinhood, Sutton Bank, and The Clearing House.

One of the exhibits included in this report:

Highlights of the report include:

- Mapping of the complex prepaid value chain and the path along which interchange revenue flows

- Close examination of Reg. II and the ways in which TCH’s letter could alter its interpretation

- Specific examples of the ways in which powerful fintechs have taken advantage of what TCH sees as a loophole in Reg. II

- Analysis of the fintech prepaid card model and the degree to which it is vulnerable to proposed changes

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world