Overview

Boston, MA

March 2008

The Evolving Landscape for Prepaid Cards in Latin America and Europe

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

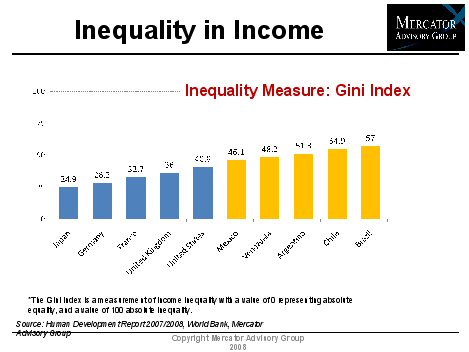

Prepaid programs and products have become more diverse and more widely available than ever before, and have garnered awareness and acceptance from consumers across the globe, including in Latin American and Europe. An increasing number of users in these regions are adopting prepaid for their payment needs. Governments in countries with highly developed payment card markets as well as those with emerging markets are issuing social benefits to their citizens via prepaid cards. Many employers have also begun to issue payroll, per diem payments, and card-based vouchers to their employees instead of paper checks. Other growing segments in Latin American and European prepaid markets include gifting, transit-ticketing, remittance and money transfers, and general prepaid cards, which are often used for travel, online shopping, payment cards for the unbanked, and other purposes. Although the response to stored-value products have been positive in developed card markets, like the UK, France, and Germany, consumers in emerging electronic-payment markets in Latin America, while more hesitant than their European counterparts, are becoming more familiar with prepaid products and cashless transactions in meeting their daily payment needs. There are certainly many potential opportunities for growth in each prepaid segment in card markets in Latin America as well as Europe, as new innovative products are crafted to meet each consumer population's unique payment needs.

"Growth in Latin American and European prepaid markets can be attributed in part to increased consumer awareness of the benefits of this form of payment, in both the public and private sectors. Although prepaid cards may currently be less popular in some emerging markets than they are in developed markets, it is expected that stored-value products will continue to be used in a greater number of applications, and introduce new users to the concept of payment cards," notes Elisa Athonvarangkul, Analyst, International Advisory Service. "Each market's unique conditions should be taken into consideration, but it is irrefutable that usage will only continue to expand as more consumers realize the advantages of prepaid cards, and new innovative products become available."

Sample Exhibit

The most recent report from Mercator's International Advisory Service provides an overview of select prepaid markets in Latin America and Europe. The report also presents a review and analysis of trends and product offerings in select prepaid segments in Latin American and European card markets, as well as a discussion of potential growth opportunities in prepaid in these regions.

This report contains 32 pages and 5 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world