Overview

In a research report, The Evolving Branch Banking Strategy, Mercator Advisory Group reviews the importance of face-to-face communication when discussing complicated financial products and service such as loans, time deposits, and investments.

“Even while many banks, credit unions, and other financial institutions are right-sizing or otherwise reconfiguring their branches, most realize that in-person service is still important to their customers and members,” comments Ed O’Brien, Director of Mercator Advisory Group’s Banking Channels Advisory Service and author of the report.

This report is 20 pages long and has 14 exhibits.

Companies mentioned in this report include: Diebold, Glory Global Solutions, Nautilus Hyosung, NCR, and Wincor Nixdorf.

Members of Mercator Advisory Group Banking Channels Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

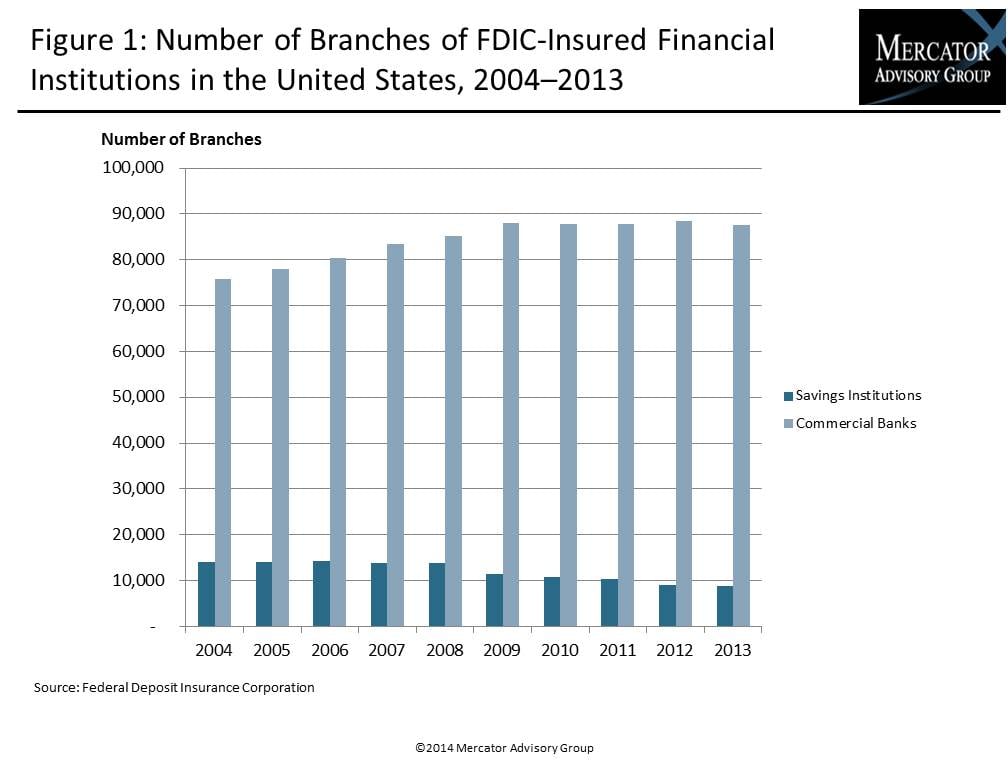

One of the exhibits included in this report:

Highlights of this report include:

- Banks and credit unions’ efforts to create branches that meet (and exceed) customer/member needs while containing costs by balancing the desire for in-person expertise with 24x7 access as well as access to digital solutions

- Emergence of new branch strategy as many financial institutions are reducing the number of branches they operate or reconfiguring their branch layouts

- New variations in branch layouts, including open concepts with dedicated zones for basic transactions, self- and assisted-service interaction, private areas for advice-based services, and teller automation and cash recycling equipment to enhance the overall customer experience

- Changes in the fundamental role of tellers and other branch through expanded sales and service training aimed at promoting cross- and up-sell efforts and increasing overall customer satisfaction

Book a Meeting with the Author

Make informed decisions in a digital financial world