Overview

When credit cards were introduced in Europe, the market was still very fragmented. For the most part, merchant acquiring was a low priority for the banking industry. The focus was on card issuance, and the acquiring business was treated as a utility with a domestic focus to facilitate those card-issuing businesses. In a fairly short time though, Europe has become a very competitive acquiring market. The Single Euro Payments Area (SEPA) initiative and regulation harmonizing cross-border payments facilitated new market entry and the evolution of new business models. The dust hasn’t settled yet.

A new Mercator Advisory Group research report, Evolution of Merchant Acquiring in Europe, reviews how the European merchant acquiring market has developed to its current state and discusses what acquirers need to do to remain competitive.

This research report contains 36 pages and 21 exhibits.

Companies mentioned in this report include: Advent International and Bain Capital (CartaSi, Concardis), Adyen, BNP Paribas Fortis, B+S Card Service, card complete, CardProcess, First Data and ABN AMRO (EMS), Mastercard, Nets, PayLife Bank, SIX Group, UNICRE, Visa, Worldpay, and Worldline.

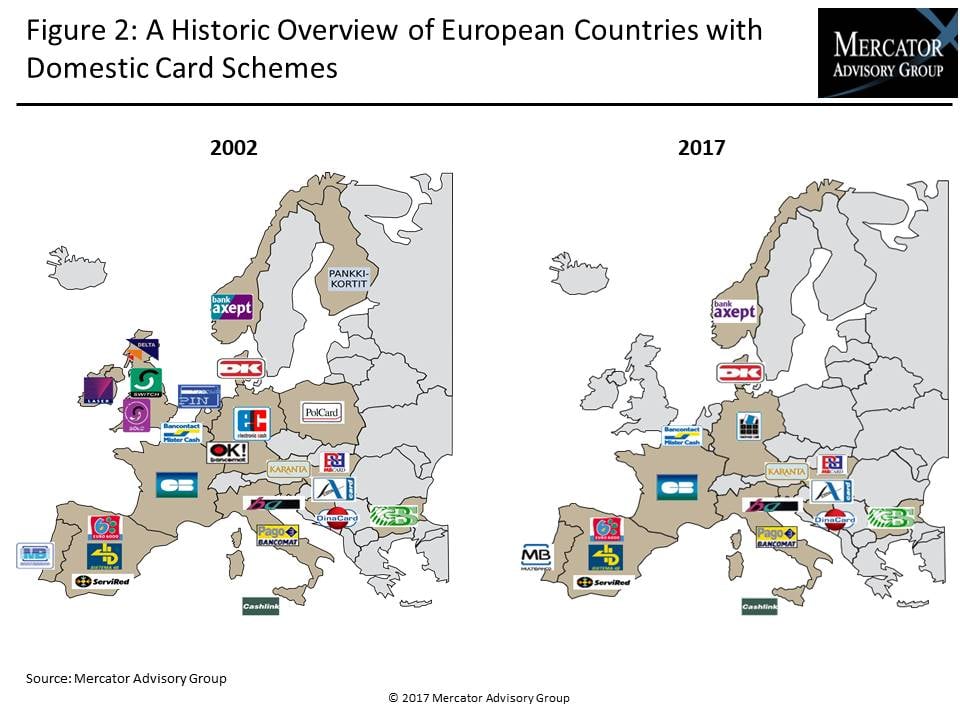

One of the exhibits included in this report:

Highlights of the research report include:

- Historical context :from domestic interbank utilities to a competitive market, unbundling of Interpay, acquiring for international card schemes, domestic card schemes

- Current credit and debit card landscape: mobile payments, card-not-present transactions, regulations (interchange, Payment Services Directive 2, authentication standard)

- Other factors affecting acquirers: alternative payment methods, Payment Initiation Services, instant payments

- Value chain shifts

- Active market dynamics for acquirers: the players, joint ventures

- Implications: Volume winner take all? Domestic focus or pan-European? sale of merchant portfolios and other options

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world