Overview

New Research Focuses on Evolution of the

ATM Banking Channel

Mercator Advisory Group report examines new ATM capabilities and increased value for financial institutions and customers alike

Boston, MA -- Financial institutions are being squeezed on both the revenue and cost fronts, creating a need to become more efficient and customer-centric than ever before. This dynamic is creating new opportunities to extend the reach of the Automated Teller Machine (ATM) channel. This channel will play an increasingly important role as FIs seek new cost savings avenues, enhanced customer interaction, and process improvements in the branch channel.

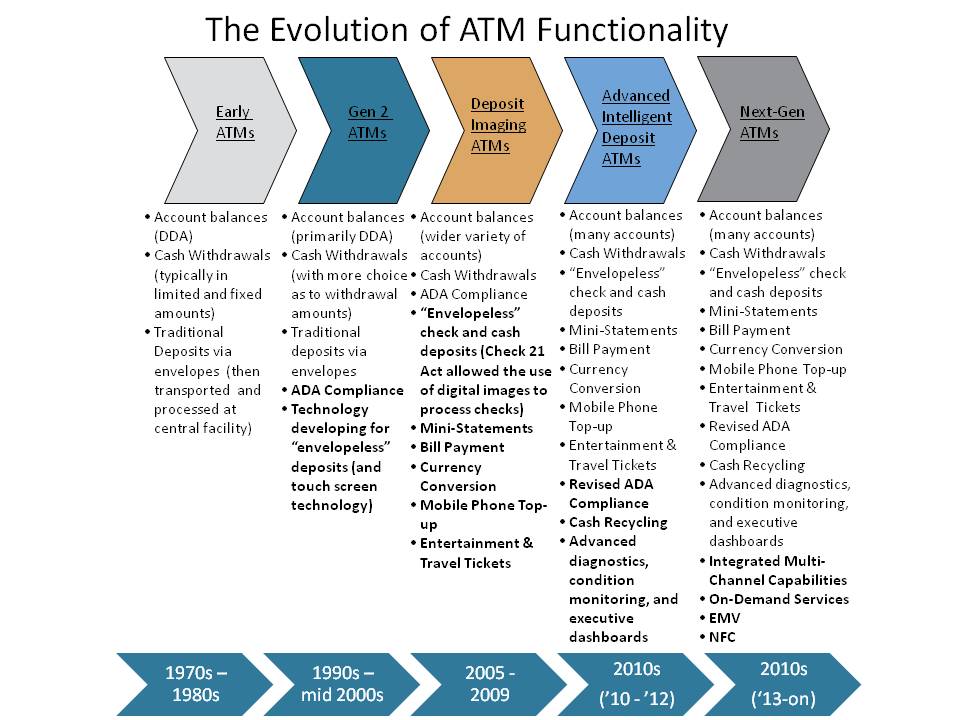

In new research, The Evolution of the ATM Banking Channel, Mercator reviews the important role that ATMs play in financial institutions' overall banking channel strategy. Intelligent deposit ATMs provide new means for financial institutions to extend ATM use beyond simple withdrawals and deposits. This report examines the wide range of additional capabilities these machines offer.

Highlights of this report includes:

An overview of the current state of the ATM channel and its role in making self-service banking more efficient and customer-focused.

The role that new-generation ATMs can play in an integrated channel strategy.

An analysis of the ways the ATM channel can add value to financial institutions and customers, creating a win-win situation.

A review of numerous capabilities available now (and in the near future) that will allow ATMs to be a foundation for an effective multi-channel strategy.

"We are at an inflection point in the evolution of the self-service ATM channel. Macroeconomic conditions are forcing financial institutions to explore new ways to reduce costs, enhance the customer experience, and decrease the workload of branch personnel on basic tasks allowing them more time for customer interaction. Advances in technology offer new, different, and creative ways for customers to conduct an increasing number of business transactions on their own. And new regulations provide a window of opportunity for many financial institutions to upgrade their ATM fleets and leverage expanded functionality," Ed O'Brien, director of Mercator Advisory Group's Banking Channels Advisory Service comments.

One of 11 exhibits in this report:

This report is 26 pages long and has 11 exhibits.

Companies mentioned in this report include: Diebold, NCR, Nautilus Hyosung, Triton, Wincor Nixdorf, UGenius, Coastal Federal Credit Union, and University Federal Credit Union.

Members of Mercator Advisory Group's Banking Channels Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world