Overview

Mercator Advisory Group’s latest research report, EMV Technology Update: EMV Classic, Faster EMV, and Now QR Code EMV, goes into detail on how these technologies work, and what card issuers need to do to ensure that EMV QR codes meet a friendlier reception than other network-backed standards.

“EMV got off to an extremely rough start in the United States,” comments Tim Sloane, Vice President, Payments Innovation, at Mercator Advisory Group, author of the report. “While the networks were able to improve the EMV experience by streamlining the process flow, a considerable amount of ill will built up, endangering the reception of a technology that normally merchants would welcome, since it greatly resembles the technology they themselves have adopted. Concentrating on the major pain point of e-commerce fraud would help give EMV QR Code the best chance of success, along with applicability in countries where the point-of-sale infrastructure is underdeveloped relative to the availability of mobile phones.”

This document contains 15 pages and 4 exhibits.

Companies mentioned in this research report include: American Express, Apple, Discover, Google (Android), Mastercard, NYCE, Pulse Star, Starbucks, and Visa.

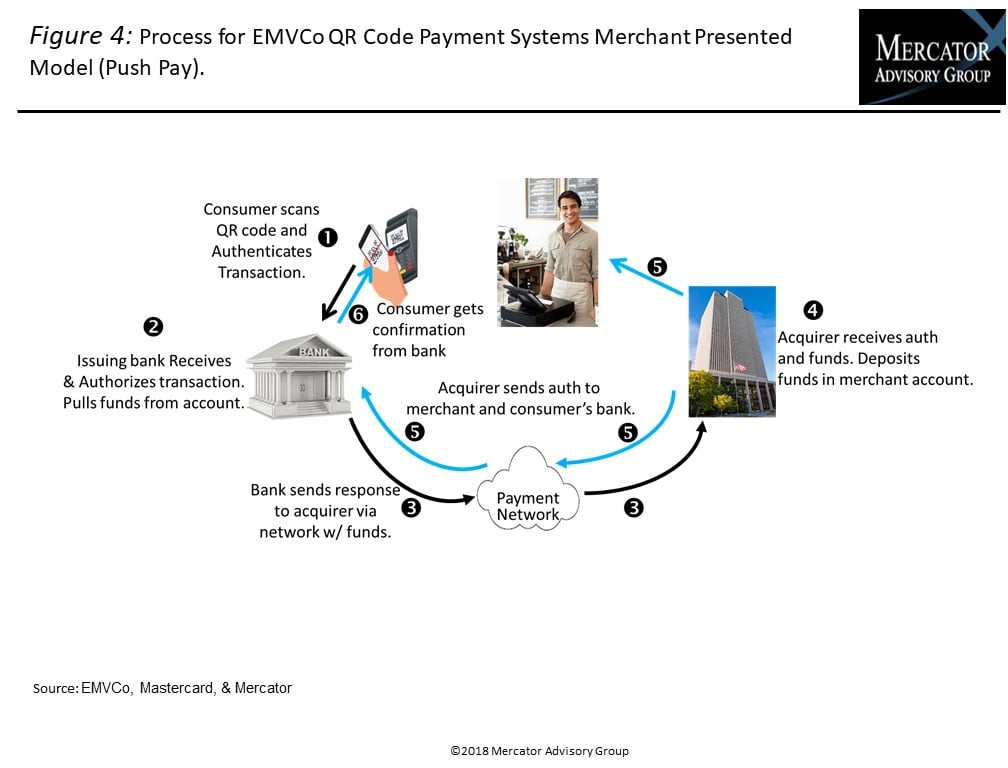

One of the exhibits included in this report:

- A brief history of efforts to improve the security and customer experience at the point of sale

- Detailed process flows for EMV, “quick” EMV, and consumer-presented and merchant-presented EMV QR Code

- Analysis of why NFC has not taken off in the United States and what might be done to change this

- Recommendations on how EMV QR could best be brought to market

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world