EMV Rollout for Commercial Card Stalled by Cost and Lack of Justification

- Date:April 03, 2014

- Author(s):

- Amy Hoke

- Research Topic(s):

- Commercial & Enterprise

- Credit

- PAID CONTENT

Overview

Boston, MA – April 03, 2014 – Discussions of strategy are just starting to heat up at financial institutions regarding strategy for commercial card issuance of EMV chip cards as mandates by MasterCard and Visa for compliance with EMV standards are almost upon card-issuing financial institutions.

Mercator Advisory Group's newest report, EMV Rollout for Commercial Card Stalled by Cost and Lack of Justification, examines the industry’s readiness to meet the 2015 network mandate for EMV implementation.

"Commercial cards as an industry represents trillions worth of spend annually and an equally significant number of physical plastics,” comments Amy Hoke, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “A lot is at stake financially in the decisions that commercial card issuers make with regard to rolling out to their respective portfolios smart cards.”

The report is 20 pages long and contains 10 exhibits.

Companies mentioned in this report: American Express, Discover/Diners Club, FIS, JCB, MasterCard, TSYS, U.S. Bank, Visa, and Wells Fargo.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

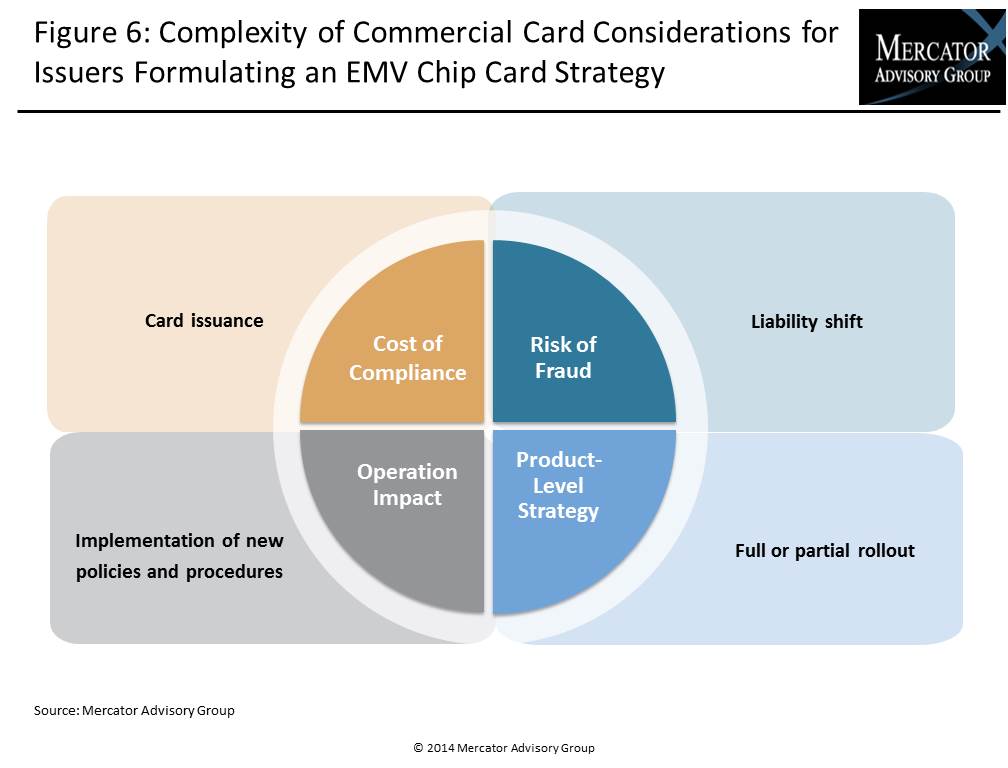

One of the exhibits included in this report:

Highlights of the report include:

- How EMV chip works for payment transactions

- Overview of the upcoming mandated conversion to EMV card issuance

- Chip implementation considerations for commercial card issuers

- Issuers’ state of readiness to meet the 2015 deadline

- Snapshots of four key industry players approach to chip and EMV strategy

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world