Overview

Boston, MA

November 2006

EMV Beyond Payments: The Bonus Card Case Study

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

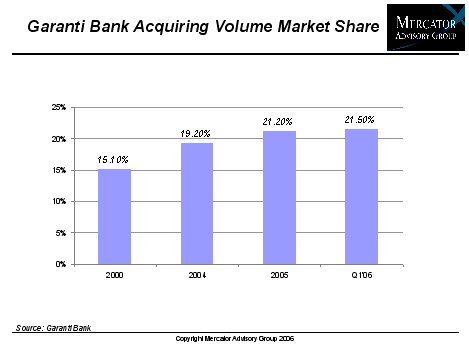

The liability shift was still many years away when Garanti Bank started its EMV migration project in November of 2000, shortly after its launch of a Bonus Program in April of the same year. Over the past six years the Bonus Card program became a huge success for the Garanti Bank and carried it to a leadership position in the Turkish card market. From 2000 to 2005, Garanti Bank gained over 6% market share on the acquiring side and more than 14% on the issuing side.

"Loyalty on EMV is frequently quoted as the magic application for profiting from EMV," comments Evren BAYRI, Director of Mercator Advisory Group's International Payments Advisory Service. "While card programs built on and around loyalty can yield solid results, simply adding a loyalty application to the EMV chip to recoup the cost of EMV migration will generate mediocre results. The Garanti Bonus Program is a great example that brings together the EMV technology and loyalty best practices such as loyalty analytics, multi-merchant loyalty, and merchant-funded loyalty programs. Learning more about the Bonus Program should be of interest to any issuer or processor planning to introduce multi-application EMV card programs that include a loyalty application."

In addition to the Bonus Card Case Study, the report provides post-EMV migration fraud update in the UK and Malaysia credit card markets, and a sample of multi-application of EMV projects from around the world.

This report contains 22 pages and 16 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world