Overview

Mercator Advisory Group has released a report describing the technical and regulatory challenges delaying the implementation of the European Union’s PSD2 Open Banking mandate and contrasts that with the rapid growth in new application programming interface (API) driven platforms that operate in the cloud. There has been a surge in platform-as-a-service (PaaS) solutions utilizing APIs.

The report, The Emergence of API Platforms: Open Banking Drives New Business Models, identifies the technical and regulatory issues that continue to be challenges to lift-off for the European Union’s open banking vision and contrasts that situation with the structures that have driven a surge in the availability of cloud platforms that utilize APIs to enable similar services, such as payments.

“In a past report we identified the game-changing value proposition associated with internet-based application programming interfaces. This report identifies why the implementation of APIs has failed to help the EU Open Banking initiative gain liftoff even as these APIs have created a surge in the number of cloud-based platforms recently announced,” commented the author of the report, Tim Sloane, VP, Payments Innovation, and Director, Emerging Technologies Advisory Service at Mercator Advisory Group.

This research report has 20 pages and 10 exhibits.

Companies and other organizations mentioned in this report include: Bank of America, The Berlin Group, Citibank, Citizens Bank, European Banking Authority, Fidor, Financial Conduct Authority, Mastercard, Railsbank, solarisBank, Visa, Vyze, and Wells Fargo.

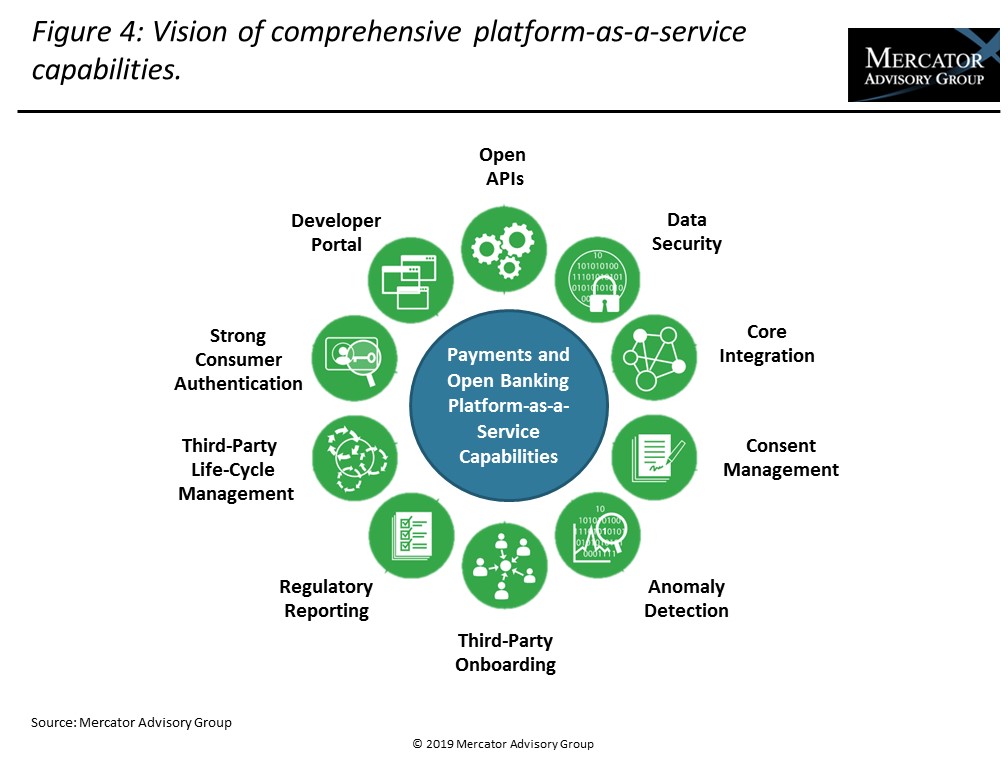

One of the exhibits included in this report:

Highlights of the research report:

- Identifies six API deployment strategies, including recent platform-as-a-service (PaaS) business models.

- Identifies the issues that have delayed, and will continue to delay, broad adoption of the EU Open Banking initiative.

- Identifies APIs currently available from major U.S. banks as a contrast to the APIs mandated under PSD2.

- Discusses the new cloud-based platform products and services released by Visa and Mastercard that support and challenge the E.U. initiatives.

- Indicates the capabilities needed to deploy a platform-as-a-service solution, which also suggests areas of the PSD2 initiative that need to be strengthened.

- Provides a predictive timeline for API-driven open banking and payments innovation within the European Union.

- Provides a predictive timeline for API-driven open banking and payments innovation within the U.S. market

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world