E-Payment Programs: Success Depends on Supplier Enablement Strategy

- Date:December 31, 2013

- Author(s):

- Amy Hoke

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Boston, MA – December 31, 2013 - Gone are the days when corporate buyers dictated payment method to suppliers. What was once payers’ prerogative—determining how they paid their suppliers—is now becoming a joint decision between suppliers and buyers.

According to Mercator Advisory Group's newest report, e-Payment Program Success Relies on Supplier Enablement Strategy, merchants are loudly saying “no” when approached by their buyers to join a network and accept card or ACH for payment. Consequently, buyers are realizing that their automated payment programs are only as successful as their enablement of key merchants.

"To ensure the success of their payment automation programs, payers are increasingly engaging in creating a supplier enablement strategy and enlisting the support of industry experts to promote and facilitate conversion of suppliers to e-payment." comments Amy Hoke, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service. “Business has responded to this need by creating a new services sector completely focused on supplier enablement.”

The report is 22 pages long and contains 9 exhibits.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

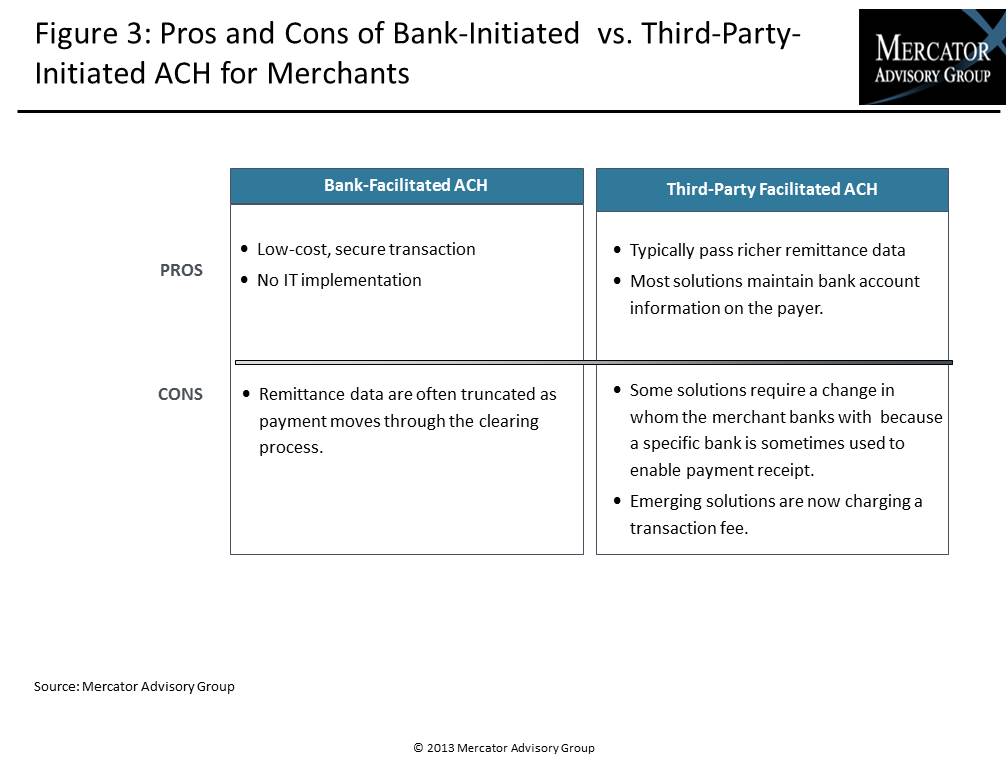

One of the exhibits included in this report:

Highlights of the report include:

- Merchant adoption of automated payments

- Barriers to adoption

- Supplier enablement targeting

- Elements of a successful supplier campaign

- Supplier enablement as a business

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world