E-Commerce Fraud Detection Platforms, Part 2: Vendor Assessment

- Date:May 15, 2020

- Author(s):

- Tim Sloane

- Research Topic(s):

- Commercial & Enterprise

- Emerging

- Global

- PAID CONTENT

Overview

The transition from in-store to remote buying is expected to continue rapid growth around the globe over the coming 5 to10 years. E-commerce adds a risk dimension to transactions that demands strong preparation by payments industry participants. The rapid growth, combined with an increasingly sophisticated fraudster universe that dynamically adapts to societal and business changes, poses a critical threat requiring strategy and ongoing investment. Mercator Advisory Group’s latest research investigates solutions for managing e-commerce fraud, taking a closer look at key vendors of solutions that can help merchants and financial institutions protect their assets.

Mercator Advisory Group’s latest research report, E-Commerce Fraud Detection Platforms, Part 2: Vendor Assessment, reviews some of the key vendors providing fraud management solutions for merchants to combat the ever present and growing online threat of payments fraud. The report provides a detailed assessment of five key vendors that participated in a survey and phone interviews of executives and adds a secondary, high-level review of more than two dozen other vendors providing solutions in this market space. The new report complements and expands upon a recent Mercator Advisory Group report titled E-Commerce Fraud Detection Solutions: Market Overview (released in February 2020), which detailed the current payments fraud landscape, defined critical evaluation criteria, and drilled down into the specifics of combating e-commerce fraud.

“There are multiple vendors supporting payments fraud using a variety of tools, many of which are point solutions designed for specific points in the e-commerce transaction journey,” commented Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service, co-author of the report, along with Tim Sloane, VP, Payments Innovation, and Director, Emerging Technologies Advisory Service, “so our goal was to drill down into the vendors who are embracing the vision of an end-to-end e-commerce fraud management platform that covers not only in-session risk but full account behavior recognition.”

This research report is 24 pages long and has 13 exhibits.

Companies and other organizations mentioned in this report include ACI Worldwide, Authenteq, BAE Systems, Behaviosec, BioCatch, Bolt, Bottomline Technologies, Chargebacks, Chargebacks 911, ClearSale, CyberSource (Visa), Cyxtera (Easy Solutions), Ethoca (Mastercard), Experian, Featurespace, Feedzai, FICO, FraudLabs, Guardian Analytics, ID Analytics, Idology, Illumio, InAuth (Amex), Jumio, Kount, LexisNexis, Mitek, Neustar, Nice Actimize, Nuance, NuData (Mastercard), OnFido, PayFone, PayPal Order Filters, Pelican, Radial, Ravelin, Riskified, RSA, SAS, Shape Security (F5), Sift (Sift Science), Signifyd, Simility (PayPal), Socure, Stripe Radar, ThreatMetrix (LexisNexis Risk Solutions), Trulioo, Veridium, and Verifi (Visa).

One of the exhibits included in this report:

Highlights of the report include:

- A detailed primary assessment and comparison of five e-commerce fraud management vendors, based on questionnaires and interviews of company executives.

- A secondary, high-level value review of 36 additional vendors across the space.

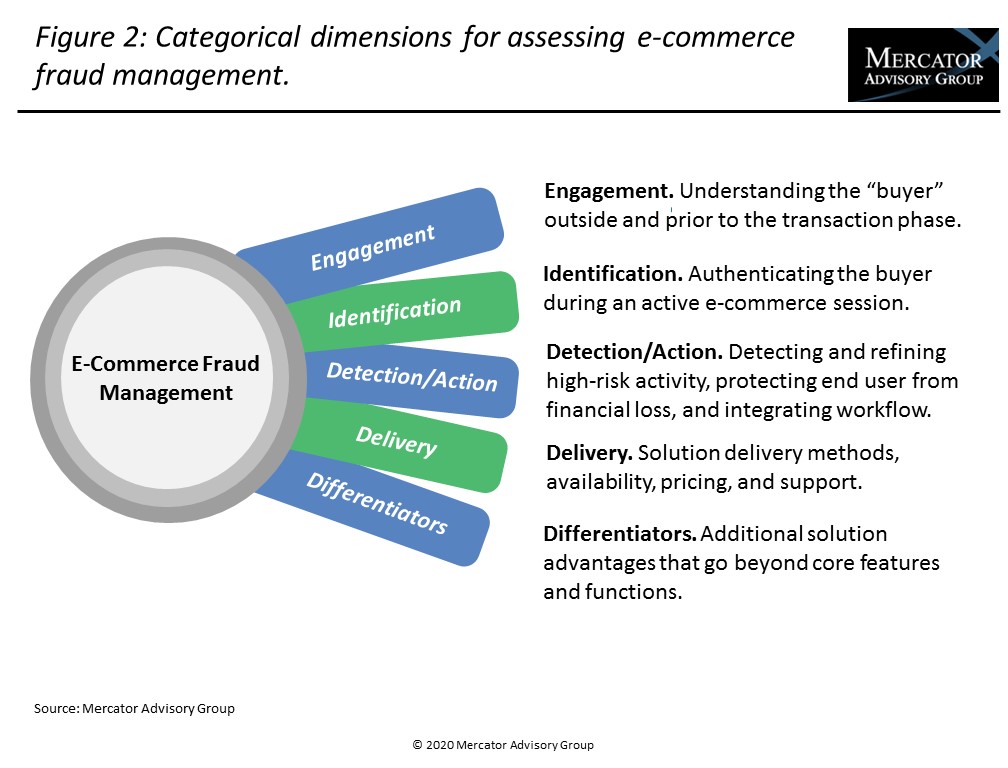

- An evaluation framework with 25 attributes across five categories, used as the assessment tool and guide for vendor responses.

- Individual category scorecards for each vendor and group summaries, along with a segmentation review for merchant priorities.

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world