Driving Up the Value of Commercial Card Acceptance for Suppliers

- Date:December 15, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Corporations, their suppliers, and the banks that issuer commercial cards all stand to gain from commercial card use. The benefits of commercial card acceptance by suppliers have been well publicized—process efficiencies, improved working capital management, strengthened customer relationships, and more. Yet, suppliers are not always happy about accepting cards for business-to-business (B2B) payments. Their reluctance may stem from their lack of knowledge of how to maximize the efficiencies of card acceptance and thereby reduce costs, both hard and soft dollar. Banks that issue commercial cards stand to reap the benefit of increased commercial card processing volumes if they improve the level of knowledge they impart to suppliers, both directly and in collaboration with their corporate clients, which are typically the buying organizations.

Mercator Advisory Group's research note, Driving Up the Value of Commercial Card Acceptance for Suppliers, recommends that issuers inform suppliers of the steps they can take to make commercial cards a win for themselves and their customers. The document presents details on the combination of factors that affects the relative value of commercial card acceptance, including interchange strategies, incremental benefits of electronic accounts payable (EAP) and cash flow impacts for all parties involved.

“There is a tremendous upside to card scheme acceptance, for which banks and buyers hold the keys,” comments Richard Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and principal author of the report.

The research note is 10 pages long and contains 7 exhibits.

Companies mentioned in the document are MasterCard and Visa.

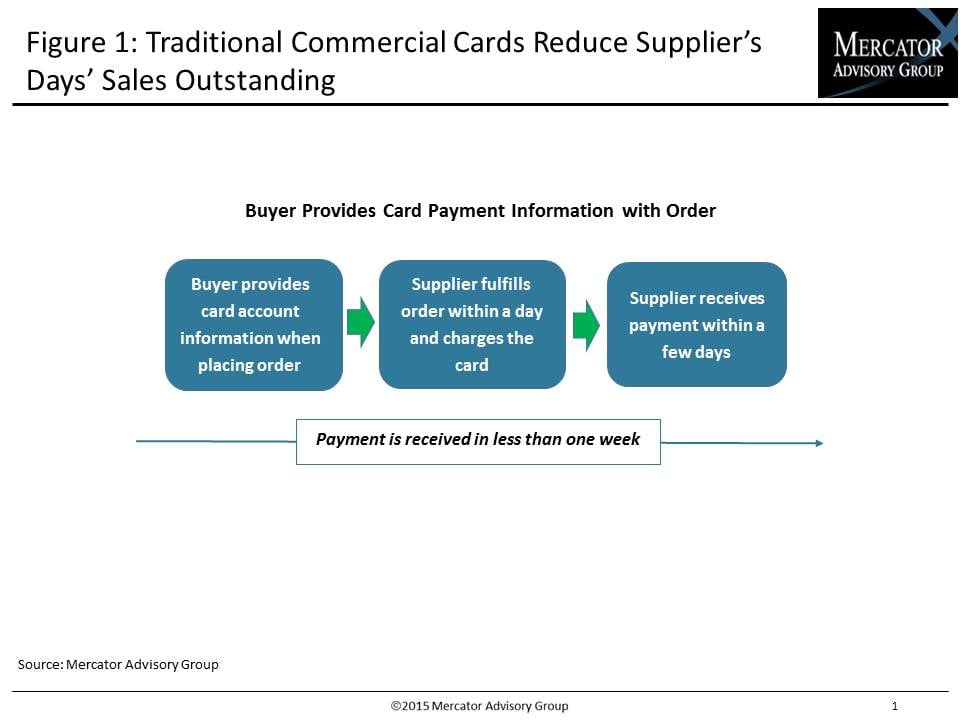

One of the exhibits included in this report:

Highlights of the research note include:

- Differences between supplier-processed and buyer-processed commercial card options

- Calculations showing how card product and purchase-to-pay process affect value

- Implications of payment timing

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world