Overview

Mercator Advisory Group has released Part 2 of a report describing new identity and authentication technology that would collapse identity platforms and authentication platforms into a single solution designed to implement the principles of self-sovereign identity (SSI). The report, Distributed and Self-Sovereign Identity Solutions: Part 2, Implementations and Suppliers, focuses on major participants in development of SSI and the approach they are taking.

The companion report, released by Mercator in August, Distributed and Self-Sovereign Identity Solutions: Part 1, Technology Overview, describes new technologies including Secure DNS, decentralized IDs, and self-sovereign identity, which is an identity and authentication model currently adopted by IBM, Microsoft, and Mastercard.

Mercator Advisory Group sees self-sovereign identity (SSI) as a major revenue opportunity for financial institutions, enabling them to monetize their customer authentication processes and data without compromising customer privacy. However, deciding which of the various rival implementations should be supported is a challenge, and this report is intended to help by profiling the technology providers in this market space.

“Self-sovereign identity (SSI) is a major business opportunity, one that places financial institutions back at the center of their customers’ lives and provides value beyond simple deposit, transaction, and lending services. Even better, this position is highly defensible since, once customers have selected a solution, network effects will make it very difficult for them to switch,” commented the author of the report, Tim Sloane, VP, Payments Innovation, and Director, Emerging Technologies Advisory Service at Mercator Advisory Group.

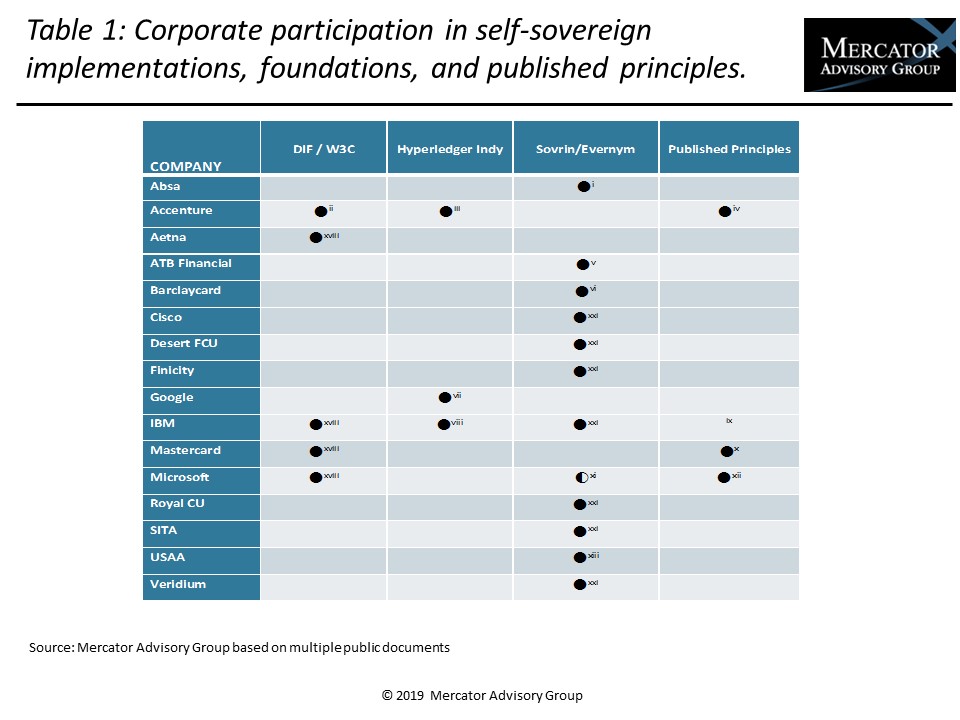

This research report has 21 pages and 4 exhibits.

Companies and other organizations mentioned in this report include: Absa, ABN AMRO, Accenture, Aetna, ANZ Bank, Barclaycard, Blockchain, BNY Mellon, [Province of] British Columbia, Calastone, Cisco, Civic, CLS, CME Group, Coinplug, ConsenSys, Credits, CULedger, Depository Trust & Clearing Corporation (DTCC), Desert FCU, Deutsche Börse Group, Digital Asset Holdings, Evernym, Fujitsu Limited, Guardtime, Hitachi, Hu-manity.co, Hyperledger Indy, IBM, Illinois Blockchain Initiative, Intel, IntellectEU, iRespond, J.P. Morgan, Korea Post, Linux Foundation, MADANA, Mastercard, Metadium, Microsoft, NEC, NewBanking, NTT DATA, OrgBook, R3, Red Hat, Royal CU, SITA, Sovrin Foundation, State Street, SWIFT, Symbiont, Unity Technologies, USAA, Veridium, VMware, and Wells Fargo.

One of the exhibits included in this report:

Highlights of the research report:

- Evernym, Hyperledger Indy, and Sovrin Foundation: Weaving SSI

- The Hyperledger Project

- SSI technology suppliers

- SSI Implementations

- Government implementations in operation today

- Other market participants

- Opportunity for financial institutions

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world