Overview

Technological issues driven by the needs of distributed ID (DID) and presumed to be years away should already guide investments in EMV 3D Secure authentication. Both the authentication technology and risk models for EMV 3D Secure should be carefully considered to protect these investments from early obsolescence, the author asserts, according to a new research report by Mercator Advisory Group, Distributed and Self-Sovereign Identity Solutions: Part 1, Technology Overview.

In past reports, Mercator discussed how biometrics would quickly replace passwords and showed the importance of mobile authentication using Fast Identity Online (FIDO). The latest report takes into account new technologies including Secure DNS, distributed IDs, and self-sovereign identity, which is an identity and authentication model currently adopted by IBM, Microsoft, and Mastercard. Part 2, the forthcoming companion report, profiles technology providers in this space.

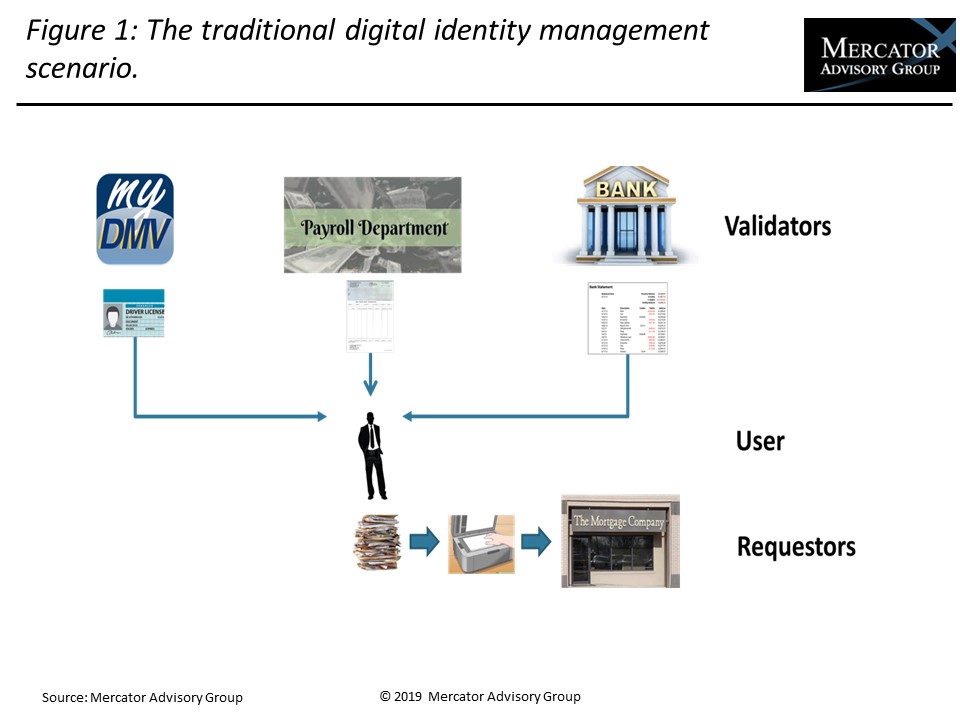

The new report explains how distributed ID (DID) and self-sovereign identity solutions (SSI) will cause the consolidation of the two platforms that financial institutions implement separately today for identity and authentication. The report indicates that consolidation benefits the consumer by delivering total control over the release of personal information and eliminating the paper chase required to collect validating paper documents and benefits the financial institution by eliminating validation of paper documents and offers the potential to participate in a new revenue generating service.

“The benefits of self-sovereign identity are clear, and major platform providers, including IBM, Microsoft, and Mastercard, have announced adoption of this model, which returns control of identity to the individual,” commented the author of the report, Tim Sloane, VP, Payments Innovation, and Director, Emerging Technologies Advisory Service at Mercator Advisory Group. “However, the more immediate concerns are that several current identity implementations appear to be in direct contrast to this model, including the Sign In with Apple implementation. In addition, the investments being made today in authentication are likely to be obsolete if these new technologies are not taken into consideration.”

This research report has 20 pages and 4 exhibits.

Companies mentioned in this report include: Accenture, Aetna, Amazon, American Express, Acxiom, Apple, Barclaycard, Desert FCU, EMVCo, Epsilon, Equifax, Experian, Facebook, Fair Isaac, FICO, FIDO Alliance, Finicity, Google, GOV.UK Verify, Harte-Hanks, IBM, InAuth, Intelius, iRespond, LexisNexis, Linux, Mastercard, Microsoft, Nok Nok Labs, NuData, Office of Management and Budget, Oracle, Replicon, SAFE-BioPharma Association, Samsung, TransUnion, USAA, Veridium, Verifiable Organizations Network (VON), Visa, W3C, and Yes.

One of the exhibits included in this report:

Highlights of the research report:

- Describes how distributed ID and self-sovereign identity work and interoperate.

- Explains how these two technologies and EMV 3D Secure are related.

- Describes how distributed ID will influence the implementation of EMV 3D Secure if the investment in EMV 3D Secure is to be protected from early obsolescence.

- Describes the timing associated with the roll-out of these technologies, how they reinforce each other, and ultimately establish a new trust framework on the internet.

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world