On-Demand Earned Wage Access: U.S. Vendor Comparison

- Date:April 17, 2020

- Author(s):

- Sarah Grotta

- Research Topic(s):

- Commercial & Enterprise

- Debit

- PAID CONTENT

Overview

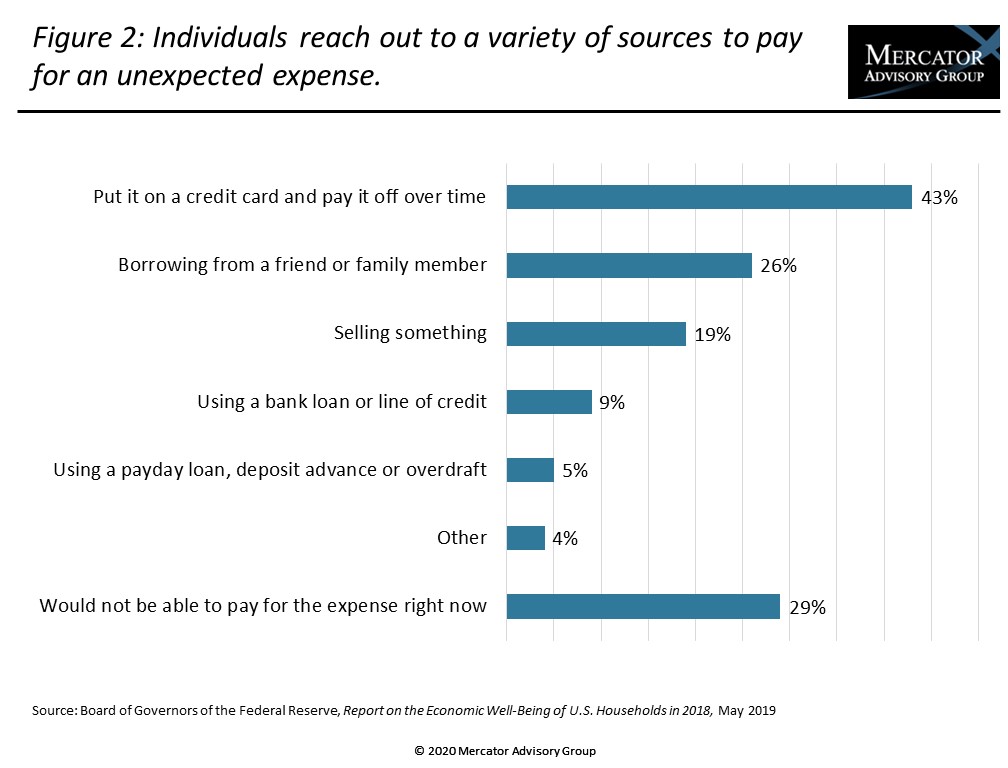

A new industry within the financial wellness market provides employees with access to wages that they have already earned but have not yet received through the traditional employer payroll cycle. Workers can request to receive a portion of their pay before payday in order to be able to pay their bills on time and avoid high-cost financing options like overdrafts, credit cards, and payday loans. By offering the option of getting paid more frequently, employers can both attract new employees and retain current employees, which saves the expense of recruiting, onboarding, and training new workers.

Mercator Advisory Group’s latest research report, On-Demand Earned Wage Access: U.S. Vendor Comparison, examines market providers of services delivered as part of employers’ benefits and also at solutions that operate as a direct-to-consumer model.

“This is a rapidly growing corner of the payments industry that has the potential to alter the way workers think about getting paid,” commented Sarah Grotta, Director, Debit and Alternative Payment Products Advisory Service, and author of the report. The solutions reviewed in this report are focused on helping lower wage workers who often face income insecurity and financial hardships. However, as the industry matures, higher-income individuals may also have an interest in getting paid based on their needs rather than a calendar date.”

This report is 27 pages long and has 7 exhibits.

Companies and other organizations mentioned in this report include: Acrisure, Blue Yonder, Branch, DailyPay, Dave, Delaget, Earnin, Evolve Bank and Trust, FlexWage, Instant Financial, Kronos, Mastercard, PayActiv, The Clearing House (TCH), and Visa.

One of the exhibits included in this report:

Highlights of the report include:

- The current market drivers for on-demand earned wage access

- How earned wage access and earned wage advance products function

- Sizing of the current market for this service

- Current regulatory considerations

- Reviews of seven providers, each including a company overview and a product review

- Advice for buyers and providers of these services

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world