Overview

Mercator Advisory Group’s new report Decoupled Debit: The Start of Mainstream Adoption? provides an understanding of the current decoupled debit market in the U.S. and how it works, why the current payment industry environment may foster more decoupled debit programs, indicators that decoupled debit may be gaining popularity and thus threatening bank-based debit, and the revised Payment Services Directive (PSD2) in the European Union.

“Decoupled debit is a payments product to watch for future development and growth. It offers merchants most of the benefits they seek in a payment—namely, independence from the card networks, less expensive transaction processing costs, a platform to extend rewards, and less fraud than traditional card transactions,” commented Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This report has 14 pages and 3 exhibits.

Companies mentioned in this report include: First Data, MasterCard, Target, VocaLink, and ZipLine.

One of the exhibits included in this report:

- Current market sizing

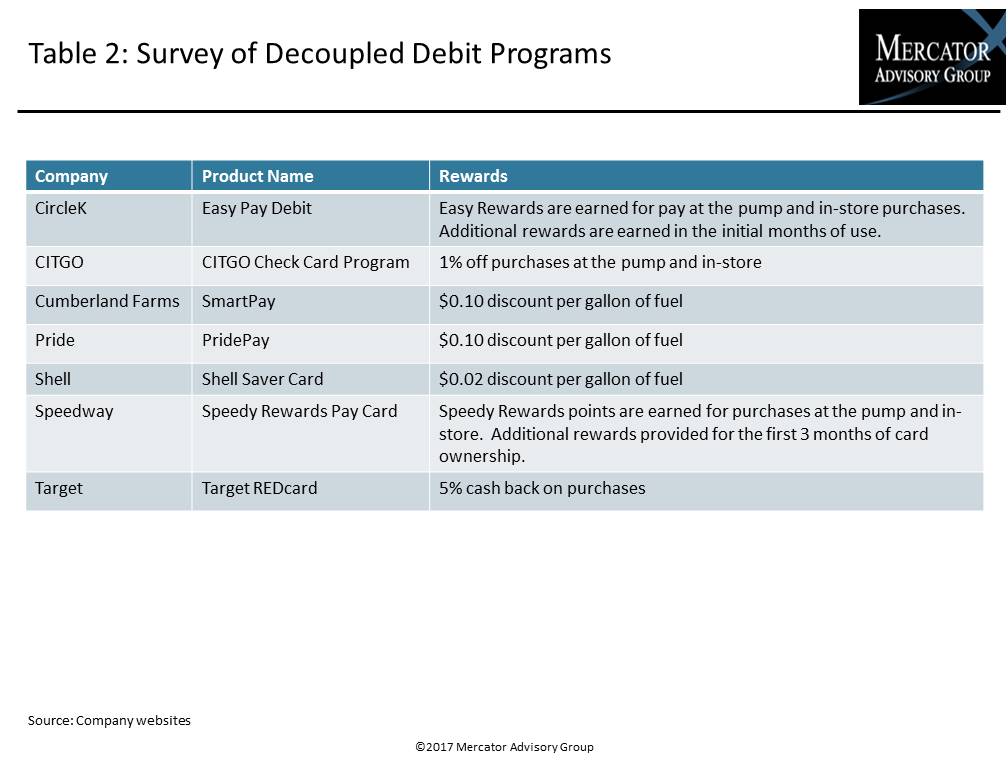

- A look at current decoupled programs

- Decoupled debit in the European Union

- Product challenges

- Market forces that are providing growth opportunities

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world