Overview

Despite the relatively heavy hand of regulators in the European Union proper, diversity and difference are what characterize the European debit card scene. That’s the conclusion of new research from Mercator Advisory Group, Debit Card Trends Across Europe, the first in a series on global debit issues that will feature the firm’s proprietary Worldwide Payments Model.

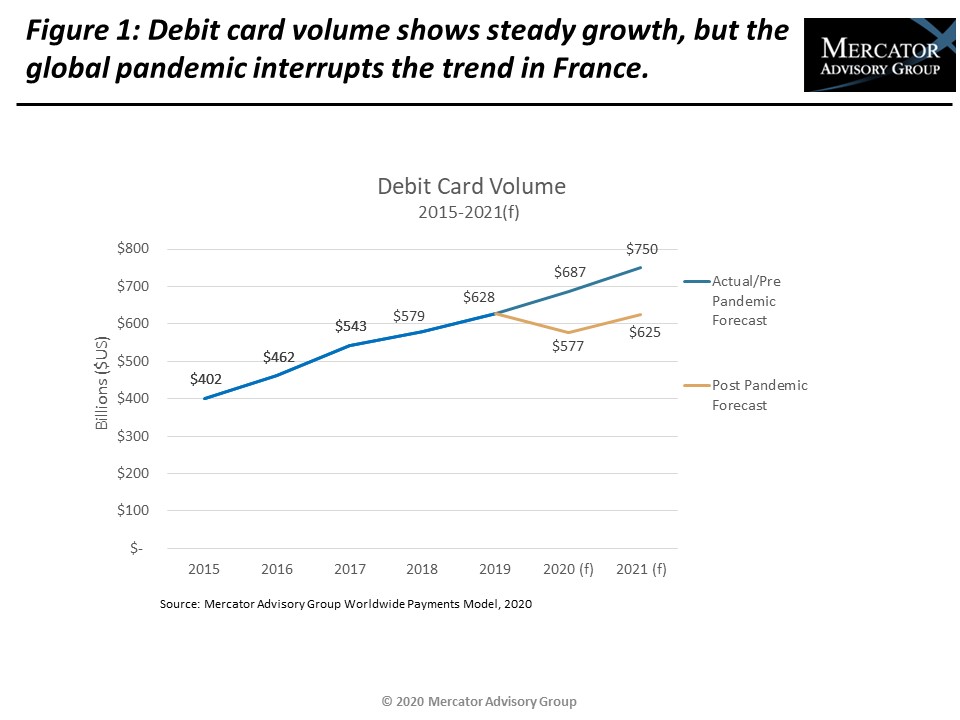

The growth trajectories for consumer debit cards in the nine European countries included in this report reveal a far from unified market. Even those countries that share a border will exhibit vastly different consumer behaviors when conducting debit card transactions. Those differences are accentuated as the global pandemic, and each country’s reaction to it, influence their respective economy. This report, the first in a series that analyzes debit card markets around the world, considers the trends in each country reviewed and utilizes Mercator’s World Wide Payments Model to provide a near term forecast for debit transaction volumes and a revised outlook given the relative impact of the pandemic.

”We find some interesting trends in debit card activity in each country that hinge on influences including the level of account ownership and financial inclusion, the territory’s history of electronic payment adoption, the strength of mobile and other remote commerce solutions, open banking and real-time payments and certainly the level of regulatory involvement in payments,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 22 pages and 9 exhibits.

Companies mentioned in this report include: Cartes Bancaires, Deutsche Geldautomaten, Mastercard, Mir, PayPal, Riksbanken, Sberbank, Twint, Visa, Yandex.

One of the exhibits included in this report:

Highlights of the report include:

- Analysis of the most influential trends in the debit card market in France, Germany, Italy, the Netherlands, Russia, Spain, Sweden, Switzerland and the United Kingdom.

- Review of account ownership, the number of debit cards issued, 2019 transaction levels and value processed expressed in U.S. dollars for comparison purposes.

- Transaction volumes processed in each country from 2015 through 2019, with pre-and post- pandemic forecasts for 2020-2021.

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world