Overview

Cryptocurrency landscape heats up as financial institutions buy in.

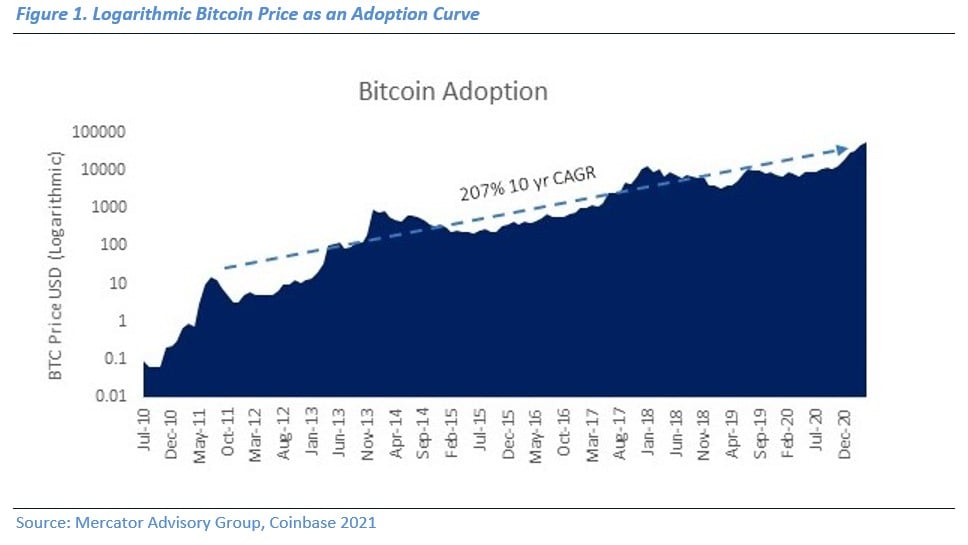

While cryptocurrencies previously stood at the fringe of the payments space, in 2021, institutional interest has increased as governments and banks have invested in the space. The U.S. regulatory agencies have acted as key drivers by creating roadmaps and guidance for companies wanting to get involved with new or existing crypto projects. Meanwhile, certain banking institutions built infrastructure to enable clients to utilize their cryptocurrencies through traditional financial practices, such as providing custodial services, enabling money transfers, and creating lending products. Globally, countries incorporate cryptocurrencies to different extents. Although many countries lag in adoption, the current trajectory of the market is favorable. Mercator believes that payment processors and fintechs should explore ways to incorporate cryptocurrency and blockchain solutions into their current models to remain competitive. A new research report from Mercator Advisory Group, Cryptocurrencies: Governments and Banks Catch Up to the Adoption Curve, examines the current regulatory and financial developments in the cryptocurrency space and highlights trends and strategies companies use to harness this growth.

“Mercator Advisory Group sees the potential in this budding cryptocurrency industry and believes there are use cases that banks, processors, and card programs can take advantage of to drive greater customer satisfaction, greater transaction volume and greater assets under management,” commented Tim Sloane, VP, Payments Innovation, and Director, Emerging Technologies Advisory Service at Mercator Advisory Group, and author of this report.

This report is 17 pages long and has 6 exhibits.

Companies and other organizations mentioned in this report: Accenture, Anchorage Bank, Bakkt, Bank of Canada, Barclays, Bitstamp, The Block, Chainalysis, CipherTrace, Coinbase, Elliptic, Ethereum, Fidelity, FIS, J.P. Morgan, Nanopay, NYDIG, PayPal, People’s Bank of China, Quorum, Royal Canadian Mint, Signature Bank, Silvergate Bank, Starbucks, Statista, Tassat.

One of the exhibits included in this report:

Highlights of this research report include:

- An overview of regulatory developments in the United States and Canada

- A broader look at worldwide players and their changing sentiment towards cryptocurrencies

- An analysis of centralized digital currencies and their implications for decentralized digital currencies

- Examinations of different blockchain infrastructures and stablecoin solutions implemented by institutions

- A review of financial products and payment solutions that current institutions have implemented to support cryptocurrencies

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world