Credit Card Collections: The Foundation for Safe and Sound Card Portfolio Management

- Date:December 11, 2019

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Mercator Advisory Group released its latest research report, Credit Card Collections: The Foundation for Safe and Sound Card Portfolio Management. The report, the second in a series of three on collections, explains the importance of preparing collections operations for the next economic cycle, a downturn that is long overdue. It also gives an overview of the U.S. revolving debt market and defines strategies for each stage of credit card delinquency.

This report complements an earlier report on back-end collections, Credit Card Charge-Off Collections Takes Brains not Brawn. The pair give credit card managers a comprehensive view of credit card collections from cradle to grave. A forthcoming report in early 2020 will discuss underlying technologies that support this market space and will compare the vendors listed in this report.

“The U.S. market is long overdue for a recession. Unemployment levels are low, gasoline is cheap, inflation is at bay, but the indicators have been good for too long,” comments the author of the research report, Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. “Experience shows that the best time to hone collections is when times are good. It is much better to test strategies when you don’t need to than have to react as the economy shifts."

This document contains 17 pages and 10 exhibits.

Companies and other organizations mentioned in this research report include: ACI Worldwide, A.R.M Solutions, CGI, Equifax, Experian, edgeverve, FICO, Infosys, Lending Solutions, SkyCom, TransUnion

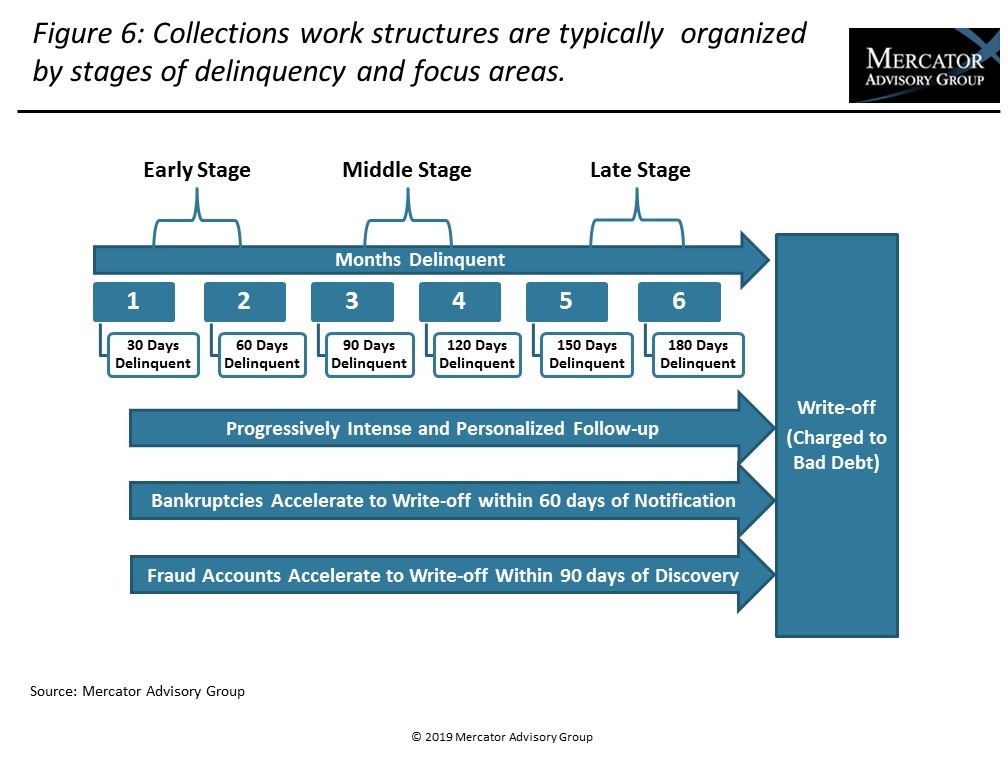

One of the exhibits included in this report:

Highlights of the research report include:

- Revolving debt estimates, U.S. market

- Average credit card debt volumes

- Credit card delinquency trends

- The importance of technology and how it needs to drive the process

- Collection aging strategies

- Using third-party resources to manage overflow and diversion

- Top collection systems

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world