The Cost of Fraud: B2B Payments Experience 10% Increase During the Pandemic

- Date:March 28, 2022

- Author(s):

- Ben Danner

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

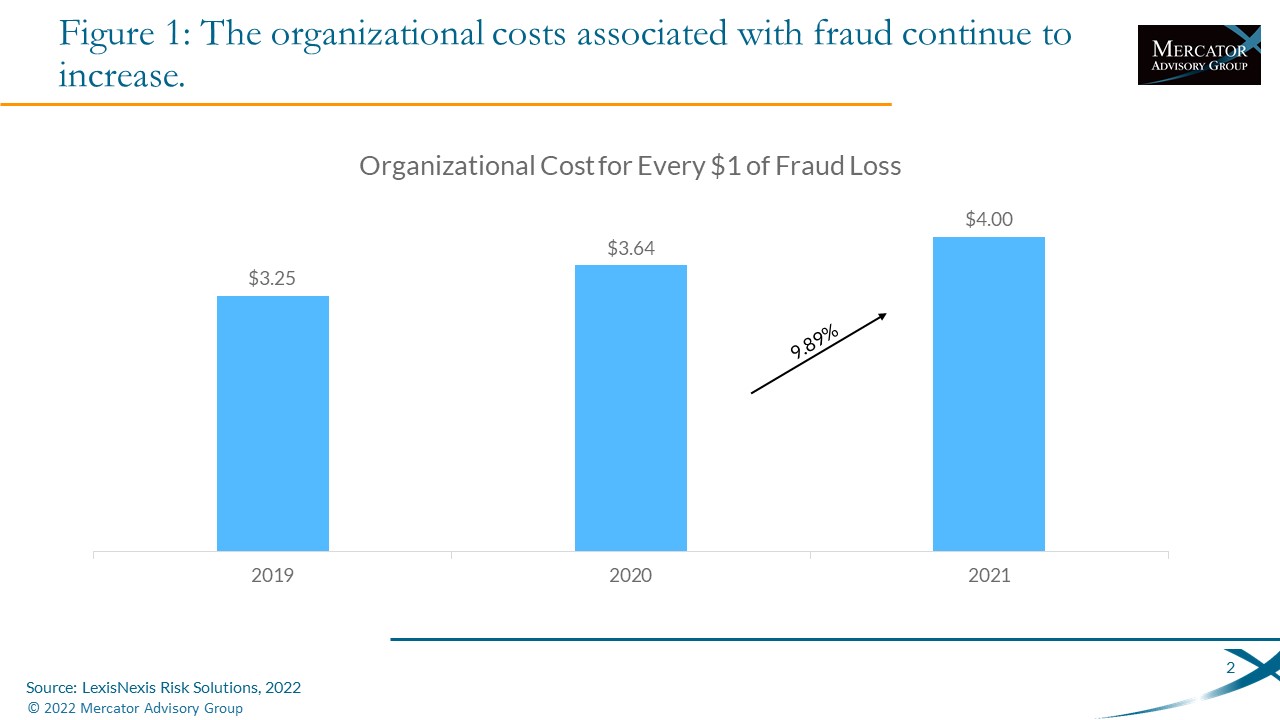

The Cost of Fraud: B2B Payments Experience 10% Increase During the Pandemic

Mercator Advisory Group released a report covering fraud in commercial payments titled The Cost of Fraud: B2B Payments Experience 10% Increase During the Pandemic. The research explores the impact of fraud with particular emphasis on the B2B payments space. Through an analysis of internal and external fraud, one can gain a deeper understanding of the most common types of schemes, what payment types are subject to the most payments fraud, and how the industry is fighting back. The report also explores the rise in business email compromise (BEC) fraud and new ways that fraudsters are targeting organizations.

Fraud is an unfortunate reality that businesses cannot ignore. In this report, we cover the trends in B2B payments fraud affecting large to mid-size organizations and the strategies they are using

to fight back. Although fraud is inevitable, organizations that stay current with fraud prevention strategies can mitigate damages and reduce losses.

“As fraudsters continue to adapt to ever-changing payment trends, organizations must be ready to defend their bottom lines,” comments Ben Danner, Analyst, at Mercator Advisory Group, and the author of the research report. “Organizations can perform several technological and non-technological interventions to combat this rising problem.”

This document contains 19 pages and 8 exhibits.

Companies mentioned in this research note include: ACI Worldwide; Association for Certified Fraud Examiners, Association for Finance Professionals, BAE Systems, Bottomline Technologies, Choose Your Own Adventure, Cybersource, DataVisor, Featurespace, Federal Bureau of Investigation, FICO, FIS, Infosec, LexisNexis Risk Solutions, NICE Actimize, NACHA, National Cybersecurity Center, Pelican, Ravelin, SAS, SEON, Sift, Simility.

One of the exhibits included in this document:

Highlights of this document include:

- Internal and external fraud trends

- Most common types of fraud schemes

- Effects on B2B payment types

- BEC fraud trends and new forms of identity attacks

- An overview of technological and non-technological fraud mitigation strategies

- Fraud vendor overview

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world