Consumers and Personal Finance: Advice Needed at All Levels

- Date:June 23, 2016

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

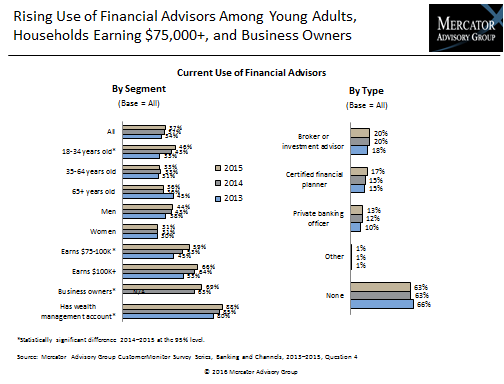

Mercator Advisory Group’s Insight Report, Consumers and Personal Finance: Advice Needed at All Levels, from the bi-annual CustomerMonitor Survey Series, reveals that 37% of U.S. consumers use financial advisors such as certified financial planners, brokers or investment advisors and private banking officers, up from 34% who did in 2013. At that time, seniors (45%) were more likely than young adults (33%) to use financial advisors, but young adults are increasingly using financial advisors. By 2015, the tables had turned, and young adults (46%) are now more likely than seniors (36%) to use financial advisors.

Accompanying the greater use of financial advisors, nearly 1 in 3 consumers claim to have a wealth management account or relationship at a financial institution, a figure that has risen steadily over the past three years. New bank account openers are twice as likely to have such a relationship. Traditional wealth management accounts are based on high-value investment instruments and financial advice, targeted to the truly affluent investor with large amounts of disposable income. However, in our survey, the definition is much broader, given that only 5% of our survey sample has a household income of $200,000 or more, a figure consistent with the 2015 U.S. Bureau of Census data. U.S. consumers at all income levels claim to have a wealth management account or relationship, though clearly the likelihood of having a wealth management account rises as household income rises.

Consumers are becoming budget conscious. According to our survey, 76% of consumers have a monthly household budget they try to adhere to, primarily to control spending (35%), to build funds for defined goals (23%) or to get out of debt (18%). Young adults (87%), high income earners (80%), wealth management account holders (86%) and business owners (90%) are especially likely to adhere to a household budget.

Nevertheless, just 26% of consumers have discussed their financial goals with their financial institution (FI). Consumers who have discussed their financial goals with their primary FI are twice as likely as average to have opened up a defined, goal-oriented account to save for specific financial goals at their primary FI. More consumers recognize that they need help to reaching their financial goals.

Responses from an expanded sample of 3,000 U.S. adults were the annual online Banking and Channels survey in Mercator’s CustomerMonitor Survey Series, conducted in November 2015, and are summarized and analyzed in Consumers and Personal Finance: Advice Needed at All Levels, the latest Insight Report from Mercator Advisory Group’s Primary Data Service.

The study highlights consumers’ use and interest in setting household budgets, defining financial goals. and designating separate accounts to fund specific goals, and services that financial institutions can provide to help build their customers’ wealth. It examines the demographic shift of using financial advisors and the type of financial advisors used, and explores the demographics of consumers most interested in financial advice from their financial institution (young adults, business owners, wealth management account holders, and higher-income earners) in terms of use of personal financial management tools, mobile and online banking activities performed and interest and preferences for targeted offers and interest in mobile-based personalized services.

“Consumers at all income levels, particularly young adults and business owners, need support and financial advice to help build their wealth and reach their financial goals. Today’s traditional, full service banks often focus their financial advice on the most affluent individuals, when, in fact, they would both benefit from helping customers at all levels build their wealth,” states Karen Augustine, manager of Primary Data Services including the CustomerMonitor Survey Series at Mercator Advisory Group and author of the report.

The report is 64 pages long and contains 34 exhibits

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of primary financial institution and type of accounts at financial institutions

- Profile of business owners, by demographics, part-time vs. full-time, and revenue generated

- Use of financial advisors by type and customer segment

- Consumers’ interest in credit monitoring and support for budgeting and other support for financial goal setting from their respective primary financial institution

- Personal financial management habits such as adhering to household budget, designating separate accounts to reach specific financial goals, and use of personal financial management tools

- Channels preferred by banking customers to communicate with their financial institutions

- Demographic profile of customer segments most interested in financial advice

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world