Consumers and Credit: New Cardholders Demand More Credit

- Date:January 14, 2015

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s Insight report from the bi-annual CustomerMonitor Survey Series, reveals that while credit card ownership remains relatively flat, user demographics are changing as young adults return to credit card use (over half of young adult in the U.S. now use credit cards, especially the 25–34 year olds, who now are as likely as average to do so).

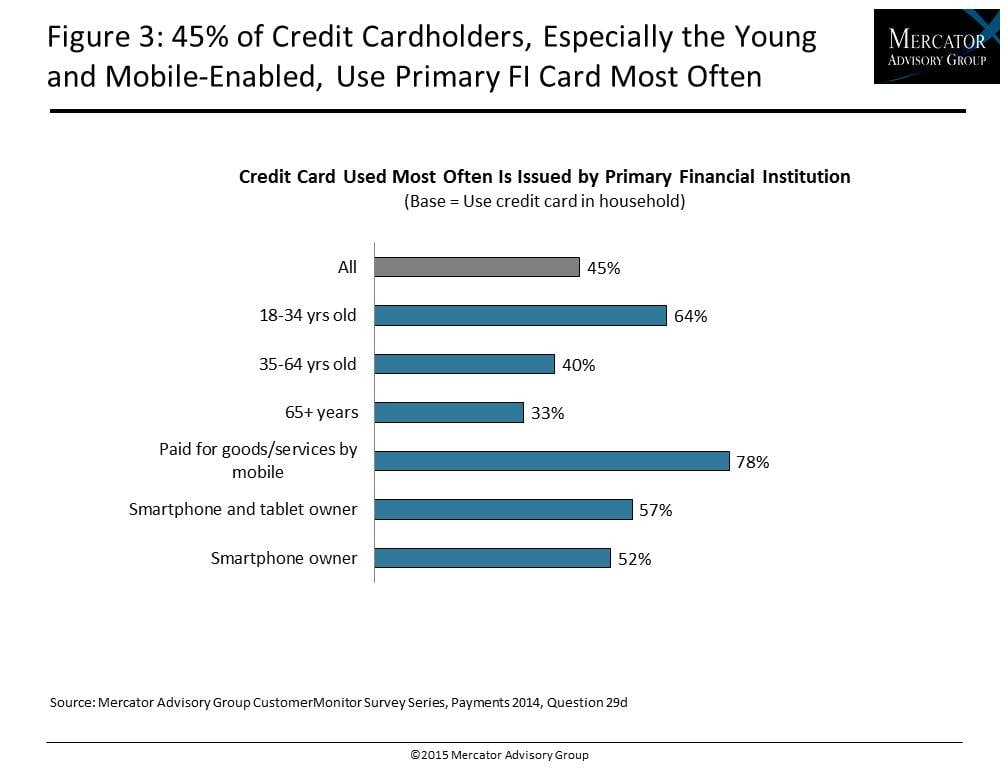

Young adults are now more likely than average to use co-branded credit cards, yet they are also more likely than average to keep the credit cards issued by their primary financial institution (FI) “top of wallet”: 64% of young adult credit cardholders report that they use their credit card issued by their primary financial institution most often. Smartphone owners (52%) and those who also own tablets (57%), especially those who have paid for goods and services by mobile phone (78%) are more likely than average to use the credit card issued by their primary FI most often.

Consumers and Credit: New Cardholders Demand More Credit, the latest report from Mercator Advisory Group’s Primary Data Service, shows that the new cardholders are especially likely to use co-branded cards to extend their credit. Mercator Advisory Group suggests that higher credit card limits along with lower fees and more valuable reward programs will motivate many to increase spending on their credit cards.

This study examines the demographic shift and changing landscape of credit card use, use of co-branded credit or charge card programs by type, shift of credit card use to other payment types, consumer experience of changing fees, APRs, balances and comfort with borrowing on their credit cards and motivators to increase borrowing and credit card spending, application channels used for general purpose credit cards and store credit cards and consumers notice of and reaction to merchant rules for credit card use and interest in mobile-based account controls.

The report presents the findings from Mercator Advisory Group’s CustomerMonitor Survey Series online panel of 3,002 U.S. adult consumers surveyed in June 2014.

“Credit card user demographics are changing and new cardholders, who appear to be predisposed to keeping their primary financial institution’s credit card at top of wallet, are demanding new tools, more valuable rewards, and higher credit limits to stimulate their use,” states Karen Augustine, manager of Primary Data Services including CustomerMonitor Survey Series at Mercator Advisory Group and author of the report.

The report is 60 pages long and contains 24 exhibits.

Members of Mercator Advisory Group CustomerMonitor Survey Series Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of U.S credit cardholder penetration, cardholder behavior, and changes to features, credit limits, APR, applications, and turn-downs

- Number of credit cards used (all vs. rewards cards vs. cards with an annual fee)

- Use and interest in EMV chip cards by type, use of contactless and co-branded credit cards by type

- Shifts in channels consumers used to apply for their most recent general purpose and store credit cards

- General purpose reward card participation, type of rewards available, most valuable reward type, and most valuable spending category

- Consumer perception and expected reaction to merchant rules for credit card use

- Interest in mobile-based account controls to limit fraud by card type

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world