Consumers and Credit 2012: Come Back, Young Cardholders - Cross Tabs

- Date:February 06, 2013

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Fourth report from Mercator Advisory Group's 2012 CustomerMonitor Survey Series probes customer and merchant "rules," attitudes, and credit card usage.

While consumer credit card use is holding steady, a full recovery to historical credit card spending levels appears to be thwarted by young adults, aged 18 to 35. This demographic is less likely than older adults to have credit cards (59% of young adults surveyed, compared to 70% of seniors surveyed) and three times more likely than seniors to reduce their credit card use in favor of debit cards (36% of young adults, compared to 12% of seniors).

The report is the fourth of eight consumer survey reports whose are based Mercator's CustomerMonitor Survey Series. The foundation of the series is data obtained during a national sample of 1,003 online consumer survey responses completed between June 8 and June 19, 2012.

One of the exhibits included in this report:

- Year-over-year trending of U.S cardholder penetration, cardholder behavior and changes to features, credit limits, APR, applications and results

- Shifts in applications for prepaid cards and corresponding channels

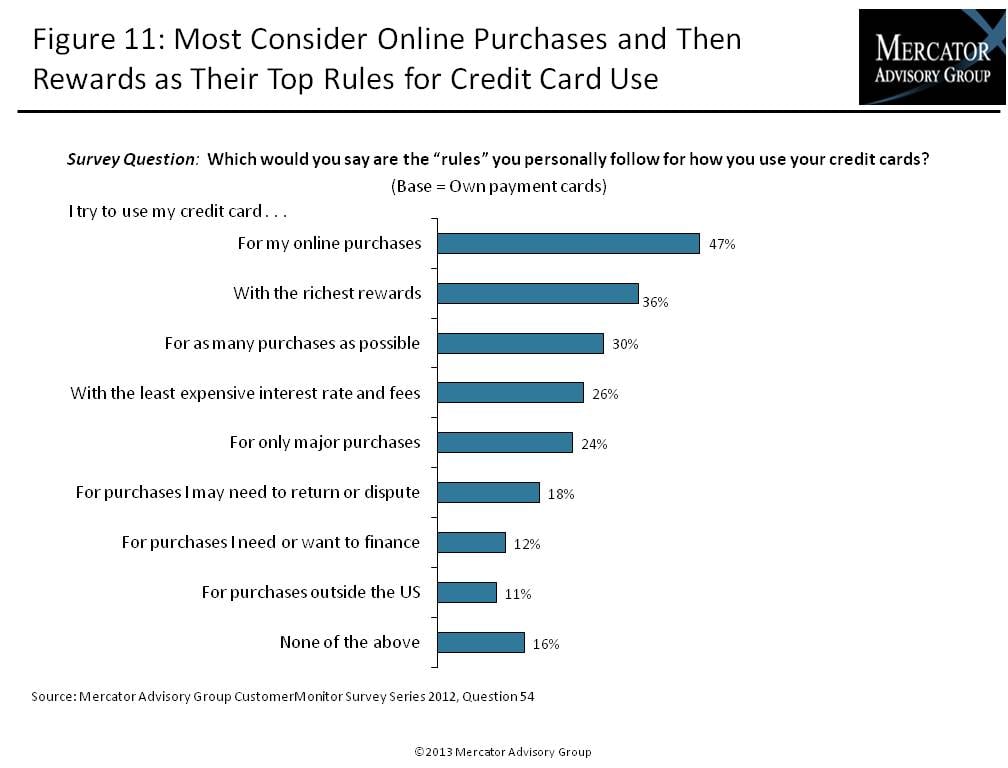

- Rules consumers follow for credit card usageConsumer perception and expected reaction to merchant rules for credit card use

- Credit cards usage outside of the United States and acceptance levels

- Usage of payment accounts on file at online retailers and the key payment type used

One of 17 exhibits in this report:

The report is 42 pages long and contains 17 exhibits.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world