Commercial Bank Account Management: The Promise of eBAM

- Date:May 22, 2013

- Author(s):

- Patricia McGinnis

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Bank account management is not rocket science. The task is not intellectually difficult, but rather operationally difficult because of the requirements for precision and accuracy with respect to constantly changing small details. For most of banking's history, accounts were administered via paper documents executed in multiples and physically delivered to the account-holding bank, whether by courier or mail, by carriage, vehicle, boat, or more recently by airmail. Technological improvements in document management have transformed the process, such that a task once requiring months for completion can now be done in days or weeks, depending on the locality.

New Mercator research, Commercial Bank Account Management: The Promise of eBAM, explores the electronic bank account management (eBAM) landscape including the challenges with established methods, interim solutions, and visions for the future. An overview of vendors offering eBAM solutions for banks and corporations is also presented.

"The process of automating bank account management in a corporation begins with the assembly of an accurate current status report, including data cleansed and confirmed by the banks involved," commented Patricia McGinnis, director of the Commercial and Enterprise Payments Service at Mercator Advisory Group and the author of the report. "Electronic updating cannot begin until an electronic foundation is laid, but even then, some countries and some banks will be unable to support EBAM in the near future."

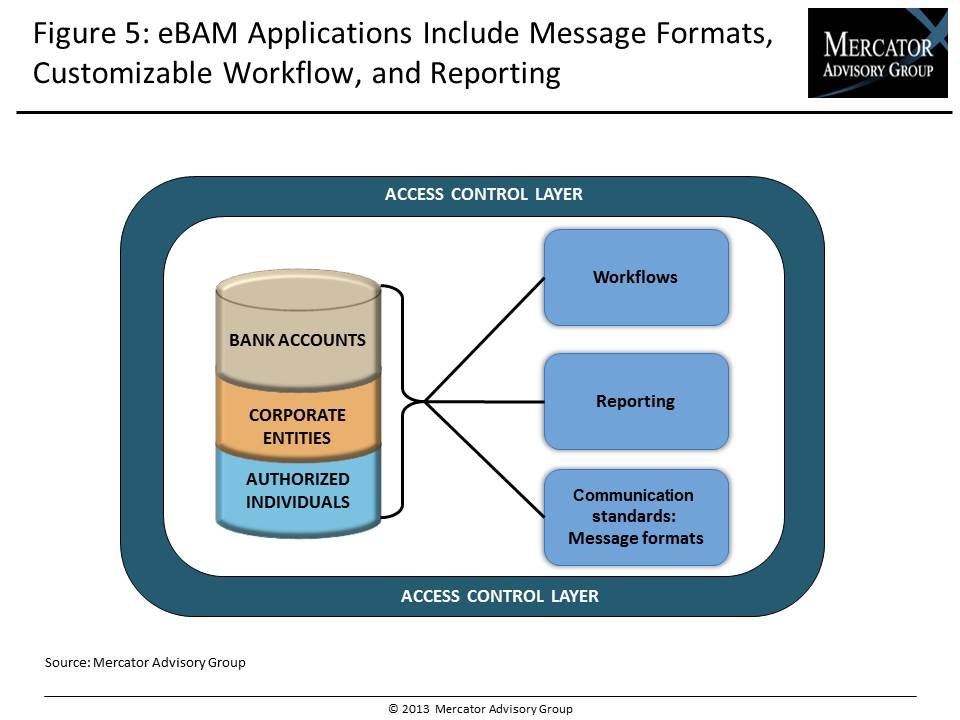

One of the exhibits included in this report:

Highlights of the report include:

- Functional description of the bank account management process

- Assessment of current eBAM initiatives

- Identification of barriers to global eBAM adoption

- Vendor introductions for those offering solutions to corporations and to banks

The report is 26 pages long and contains 11 exhibits.

Companies mentioned in this report include: Bank of America, Citibank, Deutsche Bank, HSBC, JPMorgan Chase, Royal Bank of Scotland, Fiserv, Flux, Hanse Orga, IdenTrust, Kyriba, Pegasystems, SunGard, SWIFT, Wall Street Systems, and Wipro.

Members of Mercator Advisory Group's Commercial and Enterprise Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits payments.

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world