Overview

Carrier billing, otherwise known as bill-to-mobile, is a multibillion dollar industry created out of a need to efficiently process micropayments for digital goods purchased online. Traditional payment industry stakeholders have largely ignored this segment, but as the market for digital goods expands, these solutions are poised for expansion. In new research, Carrier Billing: Teeny Tiny Gets Bigger, Mercator Advisory Group explores the potential of payments for digital content, examines what the industry can learn about delivering convenient and safe one-click payments to the mobile masses, and to what extent these solutions can disrupt the industry.

"Whether financial services companies grab onto this technology or it remains the purview of the media companies that control the market is still an unknown. However, we believe that the industry is searching for more real-time money transfer capabilities," comments Patricia Hewitt, director of Mercator Advisory Group's Debit Advisory Service and author of the report.

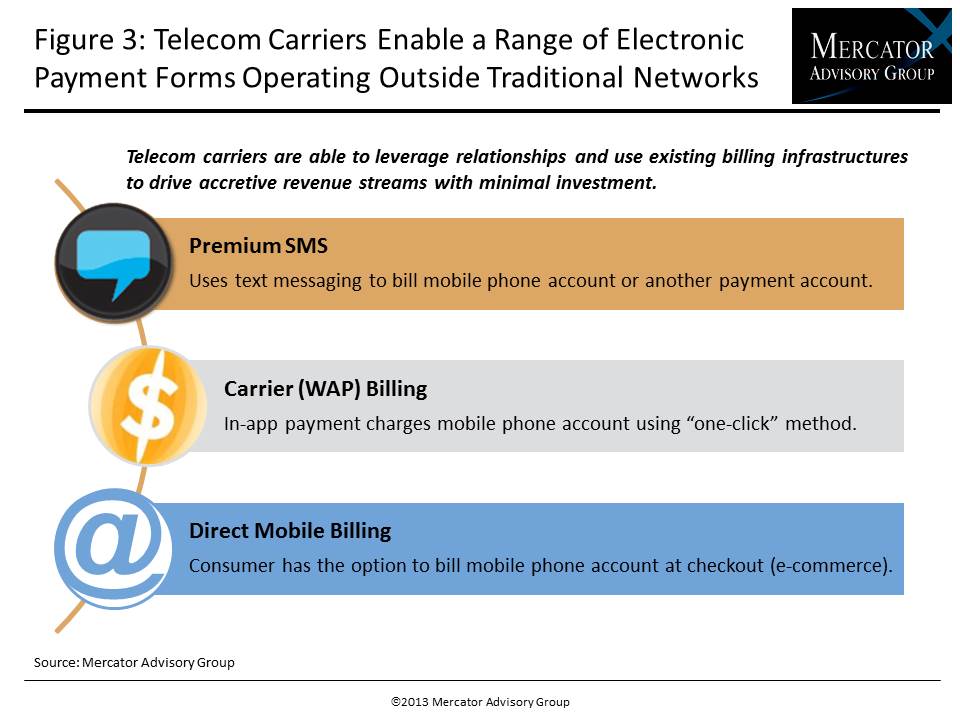

One of the exhibits included in this report:

Major highlights of this report include:

- A taxonomy of leading companies in this market and their relationship to global telecommunication giants and multifaceted digital media companies

- Estimates of consumer spend for digital content

- An overview of carrier billing's business model and primary feature functionality

- Analysis of barriers and potential to expand beyond telecom billers to financial institution partners

This report is 21 pages long and has 10 exhibits.

Companies mentioned in this report include: AT&T, Verizon, Sprint, T-Mobile, Google, Apple, Docomo, Danal, Bango, Bill-to-Mobile, Amazon, Hi-Media, PayPal, Buko, Mach, Zong, Syniverse, and Buongiorno.

Members of Mercator Advisory Group's Debit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world