Overview

Boston, MA – March 05, 2014 – Recent data breaches at major U.S. retailers have reinvigorated the discussion of how the payments industry can improve the way stakeholders protect card data. Issuers are completely rethinking how they handle fraud incident resolution while simultaneously managing an ever-expanding array of payment channels and a long-awaited shift to the EMV standard.

These changes are having a noticeable impact on the vendors that provide financial institutions with fraud detection software. Mercator Advisory Group’s most recent report Card Fraud Detection Software: Enterprise and Transaction Solutions Converge examines how changing market dynamics are reflected in vendors’ fraud detection offerings. It reviews leading solutions from around the world and provides an assessment of the future state of U.S. issuers’ fraud detection efforts.

“Competition in the U.S. market for card fraud detection solutions is about to ramp up, comments Michael Misasi, senior analyst at Mercator Advisory Group and author of the report. “Vendors that have traditionally served international markets or that have expertise in adjacent capabilities are taking aim at the mainstay solutions in the U.S.

This report contains 22 pages and 10 exhibits.

Companies mentioned in this report include: ACI WorldWide, Alaric, CompassPlus, FICO, NICE Actimize, ReD, SAS

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

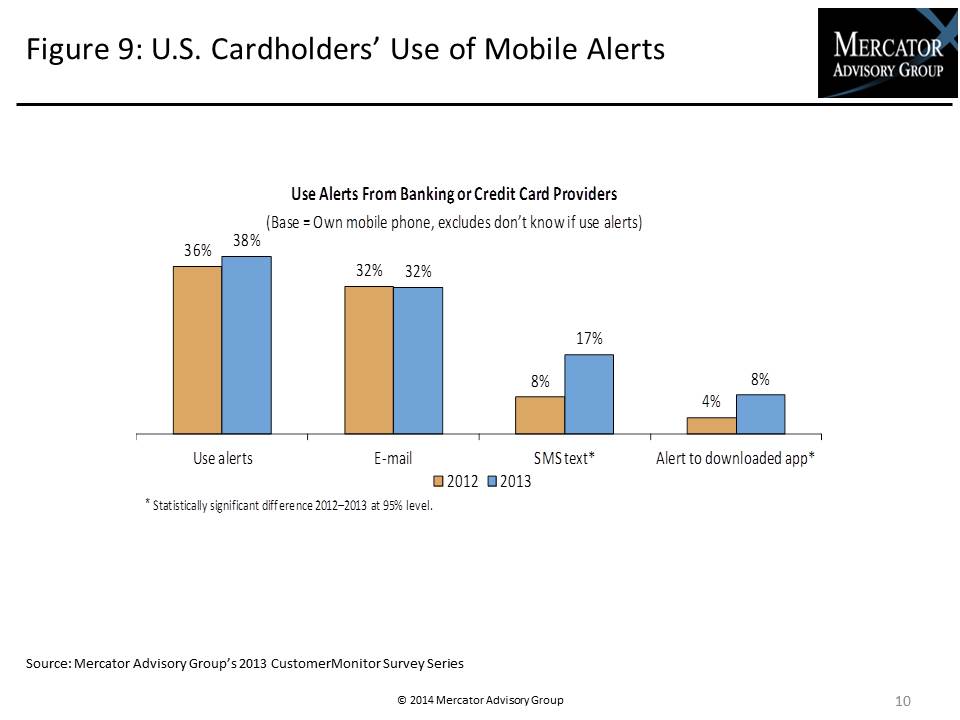

One of the exhibits included in this report:

Highlights of the report include:

- Overviews of 7 leading vendors of fraud detection software solutions and their products

- Mercator Advisory Group’s most recent estimates for total credit U.S. card fraud

- An analysis of how EMV changes the way issuers need to approach transaction scoring

- A prognosis for best-of-breed solutions in a market that is moving toward enterprise-level fraud management

- An outlook for how the payments industry can move forward from the recent data breaches at major U.S. retailers

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world