Overview

Small but Mighty, the Canadian Prepaid Market Is Experiencing Incredible Growth

Mercator Advisory Group’s most recent report, Canadian Prepaid Market: Rapid Growth and Developing Opportunities, pulls from both primary and secondary data to develop an overview of the Canadian market. While relatively small, the market is growing rapidly and presents significant opportunities for prepaid issuers.

The report examines the driving forces behind the industry’s remarkable growth and identifies recent market developments. After identifying some of the most compelling opportunities for involvement with the prepaid industry in Canada, the report concludes with recommendations for the reader.

“While prepaid serves as an important tool for under-banked Canadians, this is insufficient to explain the incredible growth of the Canadian prepaid market. In 2021, the Canadian open-loop prepaid market reached an estimated $US 6.9 billion, up 80% from 2019. The market is expected to nearly double within the next four years, forecast to reach US $13.7 billion by 2025. By comparison, the U.S. open-loop prepaid market has grown by 53% since 2019 and is projected to grow 29% by 2025, when it is expected to reach a total of US $735 billion. As these data indicate, the U.S. market is much larger than that of its neighbor to the north, but the Canadian prepaid market is growing significantly more quickly,” stated the author of the report, Laura Handly, senior analyst at Mercator Advisory Group.

This report is 14 pages long and contains 4 exhibits.

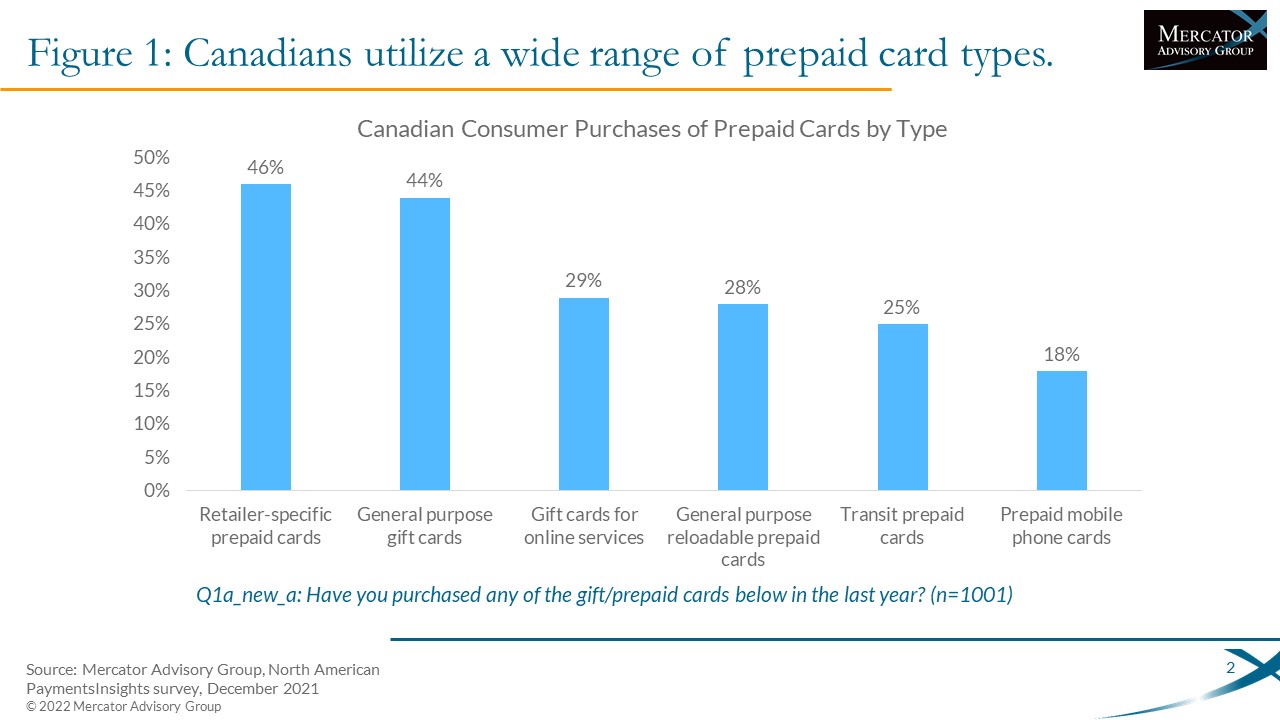

One of the exhibits included in this document:

Highlights of this document include:

- An overview of the Canadian market

- An exploration of the market’s major drivers of growth

- Key opportunities within the space

- Recommendations for issuers and processors of prepaid cards

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world