Overview

The Canadian Prepaid Card market grew by more than 10% between 2018 and 2019, according to new research from Mercator Advisory Group conducted on behalf of the Canadian Prepaid Providers Organization (CPPO). The research findings are detailed in Mercator Advisory Group’s latest research report, The Canadian Open Loop Prepaid Market: 2019.

“Expect an increased infusion of financial technology [fintech] from non-bank financial institutions such as KOHO and Canada Post, which offers the ability to load cash via the LoadHub network,” said Theodore Iacobuzio, Mercator VP Research and Director of the Prepaid Advisory Service. “This will mean increased competition not only through pricing and fees but also through unique features and benefits. An example is the prepaid card MogoSpend from Mogo, Inc., issued by People’s Trust Company, which offers users a 1.5–3.0% cash reward on purchases as well as the ability to offset their carbon footprint. Mogo will offset one pound of CO2 for every dollar spent using the card.”

Since 2004, Mercator Advisory Group has been measuring the size of the prepaid market in the United States. Early in 2016, the CPPO asked Mercator Advisory Group to bring its benchmarking process to the Canadian open loop prepaid market. Working with the CPPO and Canadian issuers, Mercator created the taxonomy shown in the exhibit below for measuring the Canadian open-loop prepaid market. This benchmark identifies opportunities, according to Mercator Advisory Group’s report, The Canadian Open Loop Prepaid Market: 2019.

This taxonomy formed the basis of the survey that was sent to prepaid card issuers and program managers in Canada. Three categories define the market more broadly than the U.S. benchmark, both because the Canadian market differs substantially from the U.S. market and in the interests of confidential reporting. The taxonomy will evolve as new categories become active and new information is made available from one year to the next for this annual benchmarking.

In many instances, prepaid cards offer advantages over other payment types, such as providing instantly issued cards that are immediately usable by the recipient, limiting funding costs, and reducing risks of fraud. Digital/mobile/virtual payments use prepaid debit in a form factor different from the familiar physical card. Many payments made at retailers using smartphone and mobile digital apps are considered prepaid; the device/form factor stores the value for payment.

This research report is 16 pages long and has 9 exhibits.

One of the exhibits included in this report:

Highlights of the research include:

- The Canadian open-loop prepaid market has 11 segments out of a possible 17. This suggests that there is room for future growth in the market.

- The total market size for 2019 in dollars loaded onto open loop prepaid cards is CAD$4.8 billion, an increase of 11.63% over 2018. This shows that the market overall continues to be healthy.

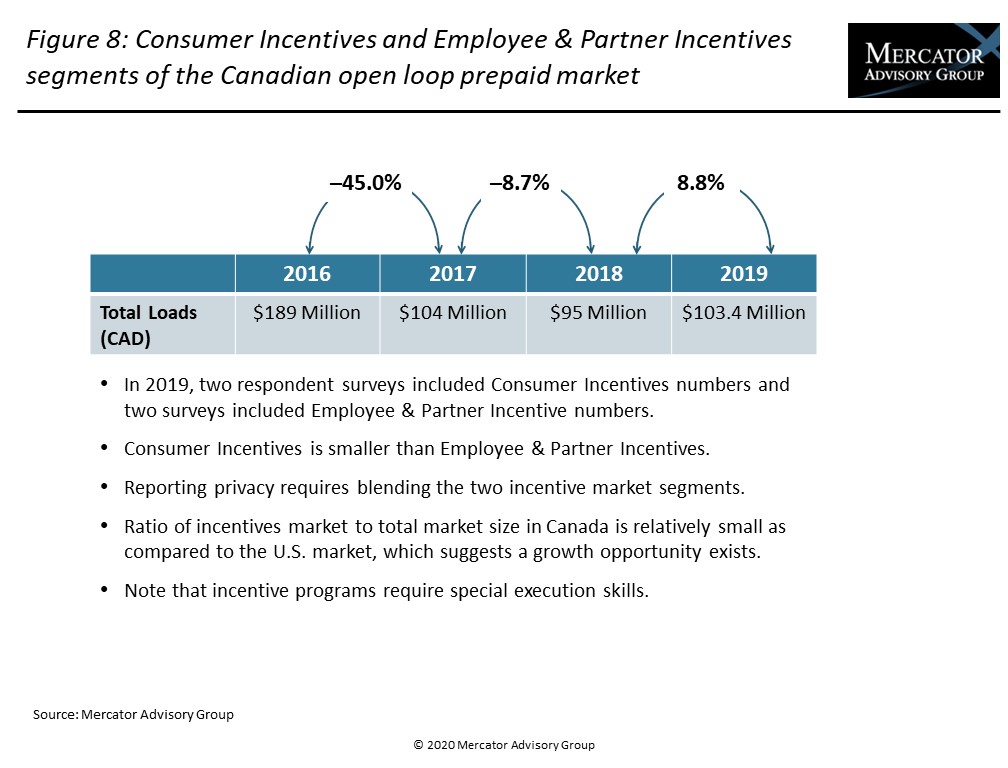

- Consumer Incentives and Employee & Partner Incentives after two consecutive declining years grew by 8.8% in 2019 to achieve a total volume of CAD$103.4 million.

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world