Overview

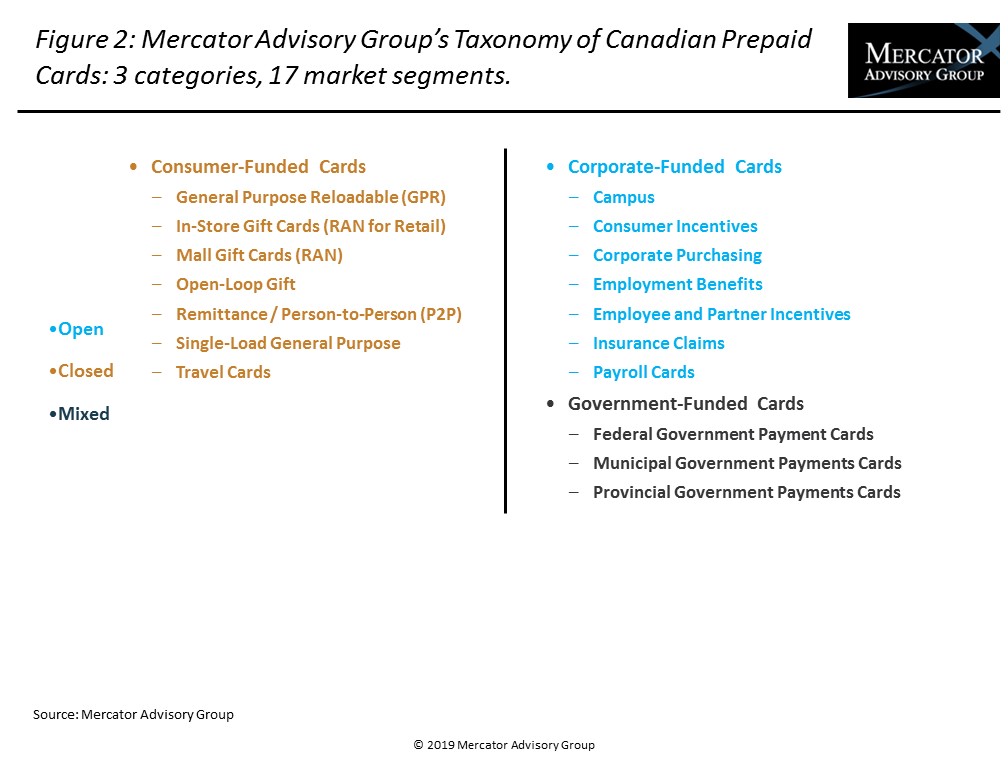

Since 2004, Mercator Advisory Group has been measuring the size of the prepaid market in the United States. Early in 2016, the Canadian Prepaid Providers Organization (CPPO) asked Mercator Advisory Group to bring its benchmarking process to the Canadian open-loop prepaid market. Working with the CPPO and Canadian issuers, Mercator created the taxonomy shown in the exhibit below for measuring the Canadian open-loop prepaid market. This benchmark identifies opportunities, according to Mercator Advisory Group’s latest research report, The Canadian Open-Loop Prepaid Market: 2018.

This taxonomy formed the basis of the survey that was sent to prepaid card issuers and program managers in Canada. Three categories define the market more broadly than does the U.S. benchmark, both because the Canadian market is different and smaller than the U.S. market and to facilitate confidential reporting. The taxonomy will evolve as new categories become active and new information is made available in future years as Mercator continues the annual benchmarking.

“As in the United States, the future of Canadian prepaid depends on providers finding places where their cards can displace cash and checks, and where prepaid cards can become a means for distributing value more efficiently than other forms of payment. Typical growth has come from government agencies streamlining their disbursement process and utilizing direct deposit on to a prepaid card for those individuals without a traditional checking account. Now that the market is becoming established, expect to see more fintechs (financial technology companies) enter the space, typically payday lenders/check cashiers. Additionally payroll direct deposit onto prepaid debit card for those who don’t have a traditional deposit account will be a large growth segment in the future. These areas grew significantly in the U.S. once government insurance secured the funds,” commented C. Sue Brown, Director, Prepaid Advisory Service, the author of the report.

This research report contains 15 pages and 9 exhibits.

One of the exhibits included in this report:

Highlights of the research include:

- The Canadian open-loop prepaid market has 11 segments out of a possible 17, which suggests that there is room for future growth in the market.

- The “Corporate-Funded Cards” category includes the Consumer Incentives and Employee and Partner Incentives segments, whose small size (Can$200 million) is in part a consequence of the fact that specialized knowledge is required to address the market’s unique requirements.

- The “Government-Funded Cards” category is new in Canada but growing as more governments utilize the cost savings associated with issuing prepaid cards instead of checks.

- The total market size for 2018 in dollars loaded onto open-loop prepaid cards is Can$4.3 billion, an increase of 9.0% over 2017, which shows that the market overall continues to be healthy.

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world