Business Banking Services: Expanding Online and Mobile

- Date:February 08, 2017

- Author(s):

- Karen Augustine

- Research Topic(s):

- Small Business PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s latest report, Business Banking Services: Expanding Online and Mobile,is the third of three Insight Summary Reports summarizing the results of the 2016 Small Business Payments and Banking Survey, a web-based survey of 1,607 U.S. small businesses (between $500,000 and $5 million annual sales) that accept payment cards, which was fielded in March 2016. The previous two reports presented the survey’s findings on payment acceptance and business-to-business payments. The new report analyzes small businesses’ use of banking services and alternative lenders.

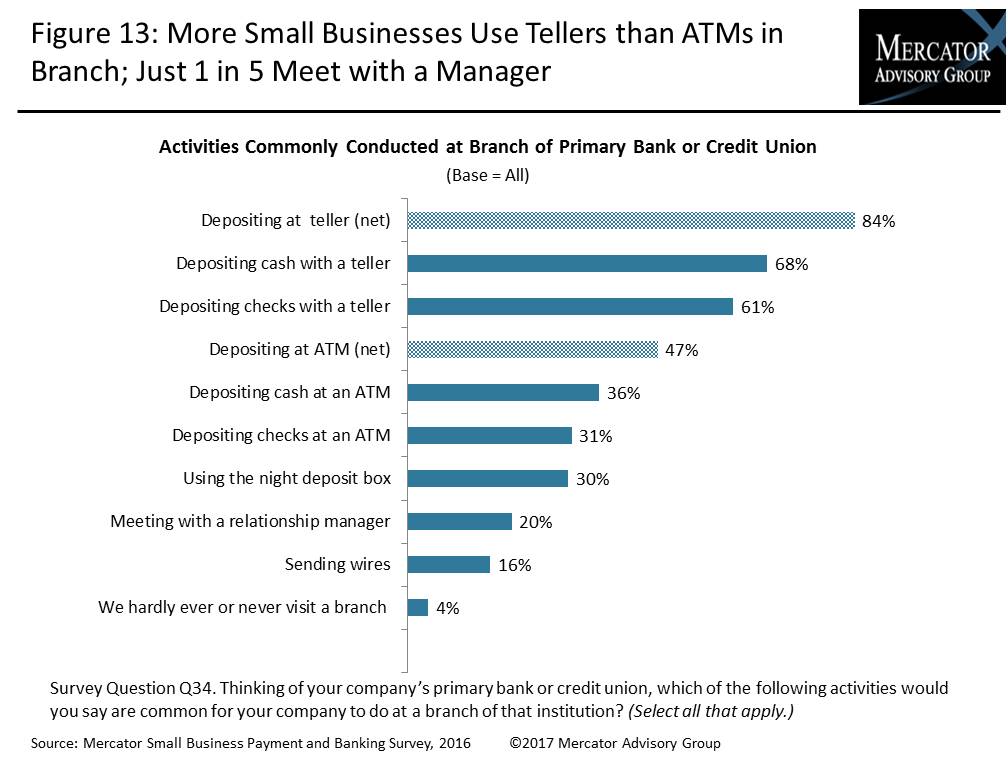

The survey finds that 84% of small businesses most commonly visit branches to make teller deposits and 47% make deposits at ATMs. Nearly all small businesses surveyed regularly visit the branch of their business bank or credit union, but far fewer, 1 in 5, go to the branch to meet with a relationship manager.

Branches are still a key channel used by small businesses and present an opportunity for financial institutions to cross-sell their business services. Yet, these branch visits are primarily transactional. More often than not, small business owners stop by their branch just to make simple transactions rather than to seek financial advice or support services, so their visits are a missed opportunity for the financial institutions. Nearly all small businesses have business relationships with a primary financial institution for deposit accounts and use the institution’s online banking services; 3 in 4 use mobile banking services. More robust online and mobile banking features provide the convenience this segment needs.

“While small businesses visit the branches primarily for quick and simple transactions, they would like to see improvements in online and mobile banking geared to help their businesses transact more easily and provide more services they need to manage and grow their business,” notes Karen Augustine, Mercator Advisory Group’s Senior Manager of Primary Data Services, the author of this report.

This report contains 40 pages and 24 exhibits.

One of the exhibits included in this report:

Highlights of this Insight Summary Report include:

- Business checking and deposit services used

- Types of loans held at primary or other banks or credit unions

- Use and interest in online and mobile banking capabilities

- Preference for online bill-pay

- Experience with online alternative marketplace lenders and reasons for use

- Wealth management relationship at primary FI

Book a Meeting with the Author

Related content

AI’s Expanding Role in Small Business

This Primary Data Snapshot—a Javelin Strategy & Research report focused on small business payment usage and behavior—shows which generative AI tools are most popular among small bu...

POS Systems Used For In-Store Card Payments

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on small business payment usage and behavior—shows which point-of-sale system brands are most popular among...

2025 Small Business PaymentsInsights: U.S.: Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between October 13 – 29, 2025, using a U.S. online ...

Make informed decisions in a digital financial world