Overview

July 2008

Brazilian Payment Card Market: Major Changes Ahead

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

The Brazilian payment card market has benefited greatly from the booming consumer credit market in Brazil and the strong economy and consumer spending growth in the country. Since 2001, the Brazilian card market more than tripled its number of cards in circulation, number of transactions, and total transaction value. Today, Brazil is one of the leading card markets outside of North American and Western Europe. If the current trends continue, by 2013 Brazil will likely become the third card market in the world by number of transactions, behind only the U.S. and China.

Terry Xie, Director of Mercator Advisory Group's International Advisory Service and principal analyst on the report, comments, "though many U.S. companies recognize the future potentials of the Brazilian payment card market, relatively few have really appreciated the opportunities that exist there today or will emerge in the next five years. The Brazilian market is a sizeable market today and expected major changes in the industry infrastructure, consumer behaviors, and regulation environment would likely help the credit card industry there to really take off in the next 5 years. At the same time, emerging product and market segments will also make Brazil one of the most innovative and dynamic payment card markets around the world."

The most recent report from Mercator's International Advisory Service provides an overview of the Brazilian payment card market while focusing on the recent trends and developments, product innovations and emerging technologies, as well as emerging market segments. Detailed discussion on the Brazilian consumer credit environment, the unique structure of the acquiring market, and the impacts of a proposed comprehensive personal credit information system is also included. At the third chapter of the report, market outlooks, observations, and key take-aways of the market are provided.

Highlights from this report include:

- After rapid growth in recent years, Brazil now has a sizable market for payment cards and the most advanced industry infrastructure among the four BRIC (Brazil, Russia, India, and China) countries.

- Issuers are increasingly competing through product and technology innovations enable by advanced industry infrastructure. Retailers might see their market share shrinking due to aggressive competition from banks and changes in the consumer credit market.

- A relatively simple market structure in the acquiring market offers unique incentives to introduce new initiatives and technologies. But the lack of open competition and interoperability are under pressure to change.

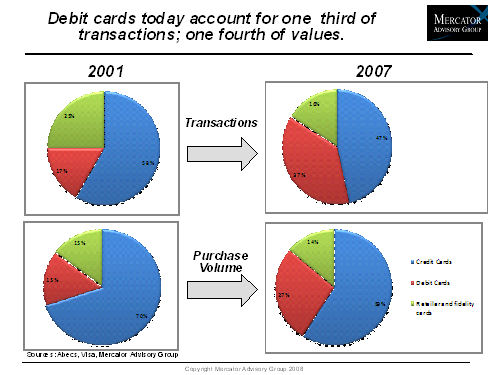

- Debit cards have seen the fastest growth so far, but credit cards will likely take off with innovative products and services and improvements in the infrastructure, such as the expected introduction of a comprehensive credit bureau.

- Looking forward, lower-income consumer segment will be a key driving force for the Brazilian market.

One of the 9 Figures included in this report

This report contains 30 pages and 9 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world