Overview

Biometrics Steadily Replaces Legacy Authentication Methods

Mercator Advisory Group released a new report covering biometric authentication titled Biometrics Use Is on the Rise for Payments: Banks and Merchants, Get Ready to Adopt Faces and Fingertips for Authentication. The research explains the current market and discusses the driving factors that influence rate of adoption and how different stakeholders can gain a foothold in this rapidly growing ecosystem.

This report covers the breadth of today’s biometric authentication technologies, including how the introduction of behavior-based security has the potential to transform the payments industry. Through outlining the success and challenges faced by global entities in implementing this cutting edge technology, this report provides readers with valuable insights on how to introduce innovative products in this field. Additionally, the legislative developments at the state and federal levels in biometrics and consumer privacy are outlined to provide readers with a comprehensive perspective on the current regulatory landscape.

"Since our 2017 report, COVID-19 and shifting consumer preferences have accelerated the deployment of biometric authentication in the payments industry,” comments Tim Sloane, Vice President Payments Innovation, Mercator Advisory Group. Sloane continues: “In this rapidly developing field, it is necessary to have a firm understanding of the potential and limitations of the technology, including anticipated challenges in tailoring it to meet your market needs. It is time for all payments and financial entities to learn about privacy concerns and legislation, new developments, and the partnership opportunities in biometrics.”

This document contains 27 pages and 9 exhibits.

Companies mentioned in this research note include: Fujitsu, Royal Bank of Scotland, Callsign, Visa, MasterCard, Apple, Amazon

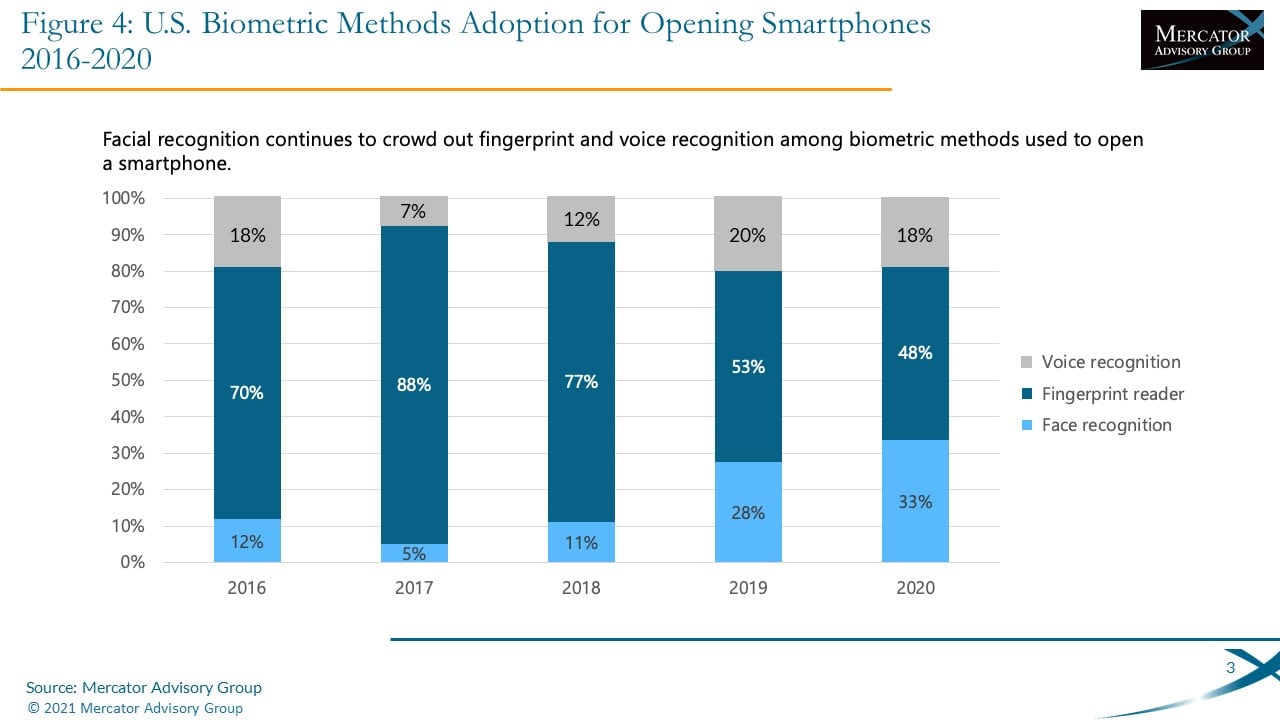

One of the exhibits included in this report:

- Overview of biometric authentication

- Leading developments in this sector, including the rise of behavioral biometrics in fraud detection and prevention

- Analysis of the U.S. regulatory landscape and the challenges faced by companies interested in consumer biometrics

- Multiple case studies on the implementation of biometric authentication in retail, banking, card payments, and digital payments

- Recommendations on partnership and revenue growth opportunities

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world