Overview

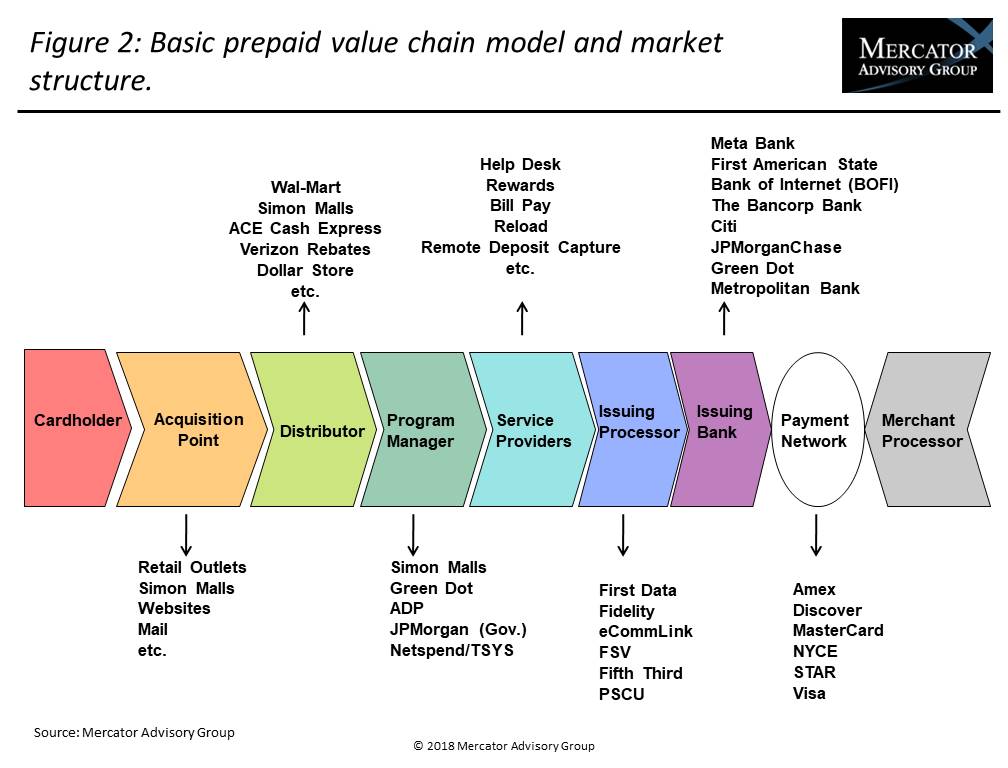

A new research report titled BIN Sponsorship of Prepaid Card Programs: Benefits for Financial Institutions outlines the basics of BIN sponsorship of prepaid card programs from the perspective of the financial institution providing the bank identification number that is necessary to connect to the major card brand networks and serve in effect as issuer of a prepaid card. The report defines the BIN sponsor’s role in the prepaid card value chain, responsibilities, ways to make money from BIN sponsorship, and the market scope.

Mercator Advisory Group’s report focuses on the many connections the BIN sponsor/issuer must have and maintain for a prepaid card program and identifies the party responsible for each portion of the transaction, areas of concern, and items to consider before becoming a BIN sponsor.

"Prepaid BIN sponsorship is poised to once again be of interest for issuing banks and credit unions as prepaid debit functionality propels the financial services industry forward. Almost every new product, feature, or functionality brought to market by fintech firms runs on a prepaid debit card platform, due to open networks and the use of application programming interfaces (APIs). The key to being a successful prepaid BIN sponsor is to follow the regulations and have continued and frequent oversight of the programs sponsored,” commented C. Sue Brown, director of Mercator Advisory Group's Prepaid Advisory Service and author of the report.

This research report is 24 pages long and has 8 exhibits.

Companies mentioned in this report include: Ace Cash Express, American Express, Discover, Green Dot, Mastercard, Netspend, Simon Malls, Visa, and Wal-Mart.

One of the exhibits included in this report:

Highlights of the report include:

- Prepaid cards can serve as a source of new revenue for financial institutions.

- The proliferation of financial technology (fintech) firms with new product offerings is fueling a need for BIN sponsors of prepaid cards.

- Now is a good time for banks and credit unions to look at options in the prepaid industry: The vast majority of new financial services products are built on a prepaid debit platform, the economy is growing, and prepaid program managers still want to have a variety of issuers to diversify their risks.

- Financial institutions’ primary functions in a prepaid program are to provide regulatory and network oversight while delivering access to major payment networks and settling transactions for all the parties in the prepaid value chain.

- Risk management is a major concern for BIN-sponsoring financial institutions, so they must establish policies and procedures to avoid unnecessary and unmanageable risks.

- Financial institutions earn income in prepaid by charging fees to program managers for the services they provide. They must make sure they are sufficiently compensated not only for the operational work they perform but for the risks entailed.

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world