Overview

Be SMART About Social Media

Boston, MA -- It is now clear to most members of the financial and business communities that all the buzz about social media and social networks is not just a fad, the online equivalent of "Beanie Babies," but rather, an important new channel for firms to communicate with customers.

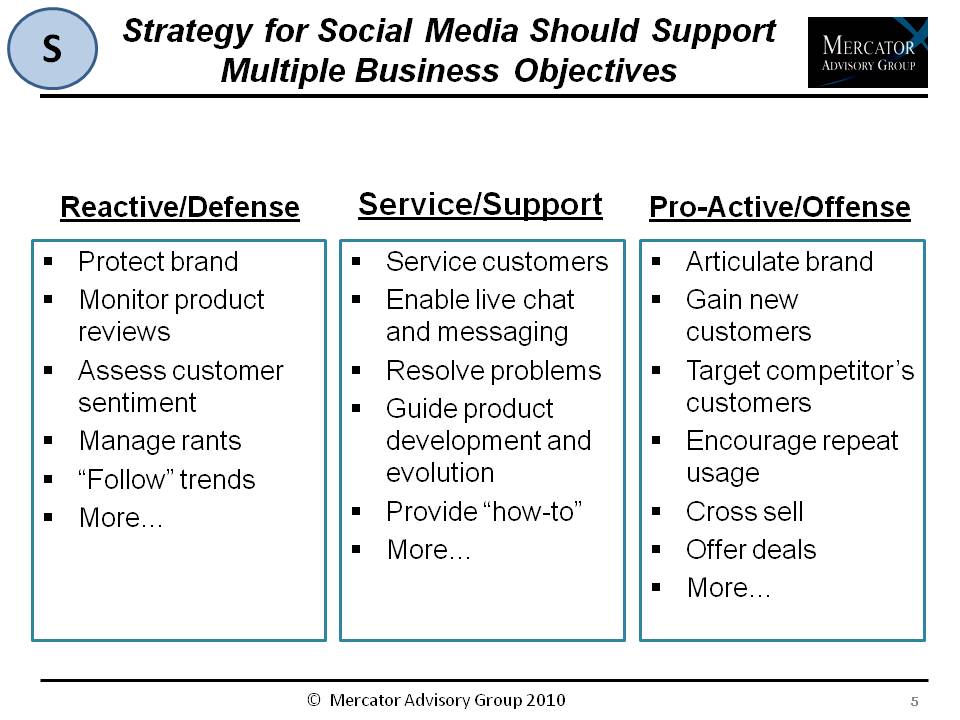

Mercator Advisory Group's new report Be SMART About Social Media discusses the motivation for financial firms to participate in social media, and introduces some definitions and categories of initiatives that will help an internal team to develop a shared vocabulary in this new domain. The report also introduces a five-part framework to assist senior management in defining the activities that would have most value for their respective firms, and in organizing their approach to the task.

"Financial firms that wish to excel at CRM must establish a presence and a voice in most of the same online communities where their customers spend time. Increasingly, that means participating in social media of many types," states Patricia McGinnis, Director in Mercator Advisory Group's Banking Service. "There is no 'one size fits all' social media solution, and no absolute 'must have' for every firm. Instead, social media offer an unprecedented opportunity for each firm to develop, refine and deliver a brand reputation and a customer service and relationship management strategy uniquely its own."

Highlights of this report include:

Interaction via social media is fast becoming a major channel for Customer Relationship Management (CRM), and in fact, the primary channel for reaching some kinds of customers.

Mercator's SMART Social Media framework will guide financial firms towards best practices by highlighting five areas that merit (and require) explicit organizational attention.

Social media, applied in a disciplined and measured way, will become a significant advantage to the firms that employ these tools creatively, strategically, and transparently with their customers.

Firms with more experience have concluded that consigning social media to a marketing-driven effort will in all likelihood limit the effectiveness of the initiative, and result in significant wasted opportunities to leverage new understanding of customers, products, and market segments.

Firms that want to be leaders in leveraging social media will have to design their own measurement standards and benchmarks for most initiatives, and be prepared to consider some efforts "experimental" as opposed to investments with predictable returns.

One of 10 exhibits in this report:

This report is 33 pages long and has 10 exhibits.

Companies mentioned in this report include: Best Buy, Citibank, Dell Computer, Facebook, LinkedIn, Twitter, SunTrust, LiveSolid, YouTube, Google, Nielsen, WPP, Socialware, HootSuite, American Express, PNC, Geezeo, HubSpot, SAS Institute.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world