Overview

“The mobile payment app environment in Asia is a completely different ecosystem from Western countries, where mobile payments industry is more fragmented, has greater competition, and contains many long-standing legacy players. Surely, Asian mobile network providers are a force to be reckoned with around the globe and can provide some lessons for U.S. and European mobile payment app providers,” commented Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group, and co-author of this report.

“Alipay and WeChat Pay have built all-encompassing mobile commerce platforms that do just about anything related to commerce and social interaction in China. There is nothing like either of them in the West, which has a multiplicity of overlapping mobile payment providers and financial institutions. However, Western mobile platforms can certainly emulate some of the Asian mobile integrated features and solutions that have created a user base of over 1 billion people,” said Raymond Pucci, Associate Director, Research Services at Mercator Advisory Group, and co-author of this report.

This report is 19 pages long and has 6 exhibits.

One of the exhibits included in this report:

Highlights of this research report include:

- Evolution of payments in China and India

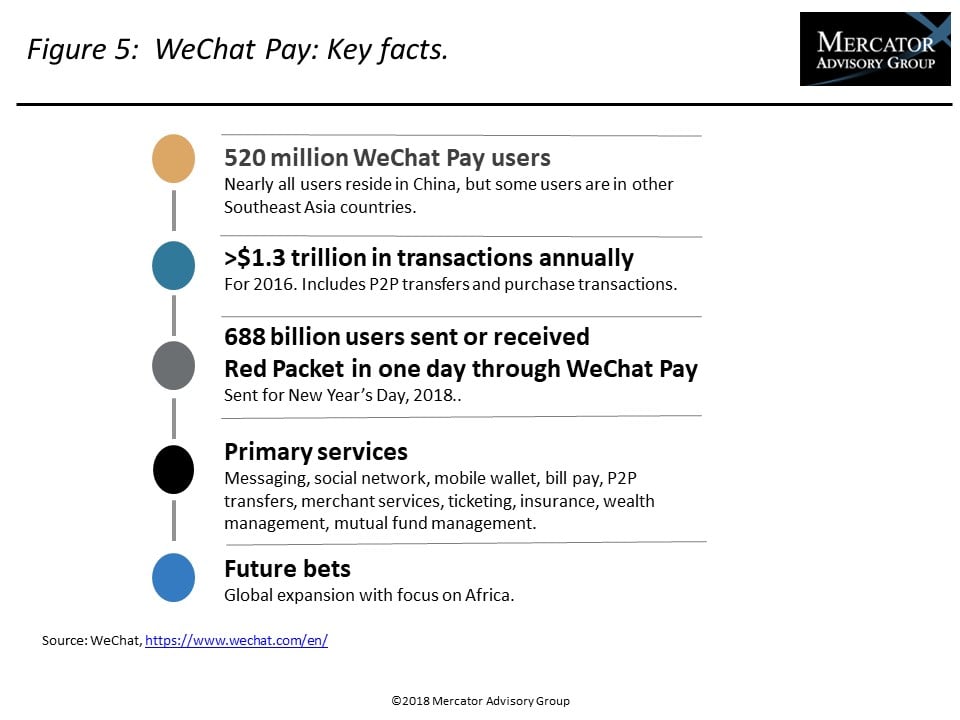

- A look at Alipay, Paytm, and WeChat Pay

- How integrated app solutions build user adoption

- Global partnerships that strengthen mobile apps

- What this means for the U.S. payment providers

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world