Overview

Boston, MA – September 3, 2013 – In this research report, Anticipating Omnichannel Banking: Channels and Core Systems Interoperability, Mercator Advisory Group reviews how the core missions of branches are fundamentally changing, as well as the roles of each of the constituent channels.

“The road map for future channel growth and efficiencies lies in an emerging omnichannel banking paradigm under development at various financial institutions. Many FIs, with large banks leading the charge, are seeking ways to provide 360-degree views of their customer needs and behaviors, the ultimate goal being superior customer engagement,” comments Ed O’Brien, director of Mercator Advisory Group’s Banking Channels Advisory Service and author of the report.

This report is 23 pages long and has 13 exhibits.

Companies mentioned in this report include: CSC, FIS, Fiserv, Harland Financial Solutions, IBM, Infosys, Jack Henry & Associates, MicroStrategy, Misys, Open Solutions, Oracle, SAP, Tata, and Temenos.

Members of Mercator Advisory Group Banking Channel Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

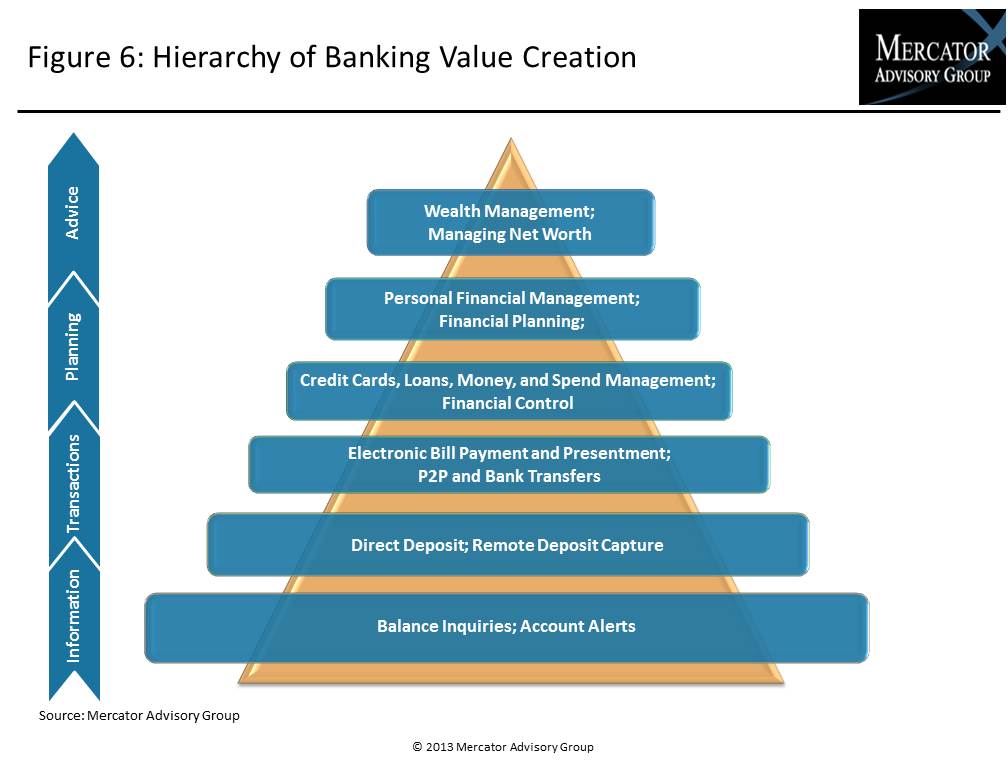

One of the exhibits included in this report:

Highlights of this report include:

- Discussion of the fundamental change occurring in the primary mission of banks and other financial institutions from a transaction-oriented relationship with customers to a more engaged one involving much interaction

- Description of significant alterations that will be required in the way FIs organize and manage their operations to achieve this change, including revamping processes, systems, and organizational structures

- The need for continuous, real-time updates of underlying account information and customer behaviors to this new customer relationship

- New strategies and improved processes needed to understand and engage with customers and support the transition to omnichannel banking

Book a Meeting with the Author

Make informed decisions in a digital financial world