Overview

When companies are looking at regions for overseas investment, Africa generally comes in last in terms of overall attractiveness. On the surface, it is easy to understand the payments industry’s reluctance to invest heavily in Africa. But Africa is a continent filled with potential for e-payments and within the next three to five years, the global payments industry will increasingly look to Africa as a major source of future sustained e-payment growth.

Africa faces similar challenges to those of other world regions that have many developing economies, like improving financial inclusion and developing a wide network of e-payment acceptance. However, many markets across Africa have already made strides to overcome these hurdles and are enjoying robust growth. How rapidly the remaining markets are able to accomplish similar goals will determine whether the continent becomes a hub of e-payment growth and innovation internationally in the near and intermediate future.

Mercator Advisory Group’s latest report, African Payments Markets, 2014, provides an overview of the African payments landscape, with estimates on account ownership, payment card penetration, branch and ATM use, mobile payment use and the continent’s e-commerce potential in the years to come. In addition, the report details recent and proposed payment technology and innovation developments across Africa.

“With a total population that exceeds 1 billion, Africa is home to approximately one-seventh of the global consumer base. However unlike other regions around the world, interest in developing Africa’s electronic payment potential has been stunted, with the global payments industry focusing primarily on Asia and South America as major areas of investment. While this trend has begun to shift in recent years, the continent remains largely untapped, despite its significant potential. Although this potential will take a number of years to be realized, the size of Africa’s electronic payment potential means that the region will inevitably become a major area of payment investment in the near future,” comments Tristan Hugo-Webb, Associate Director, International Advisory Service at Mercator Advisory Group and the primary author of the report.

This report contains 26 pages and 10 exhibits.

Companies mentioned in this report include: MasterCard, United Bank for Africa, Grindrod Bank, Ecobank, Multicaixa, Standard Bank, First National Bank, Vodafone, EcoCash, Equity Bank, iKaaz, and BankservAfrica.

Members of Mercator Advisory Group’s International Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

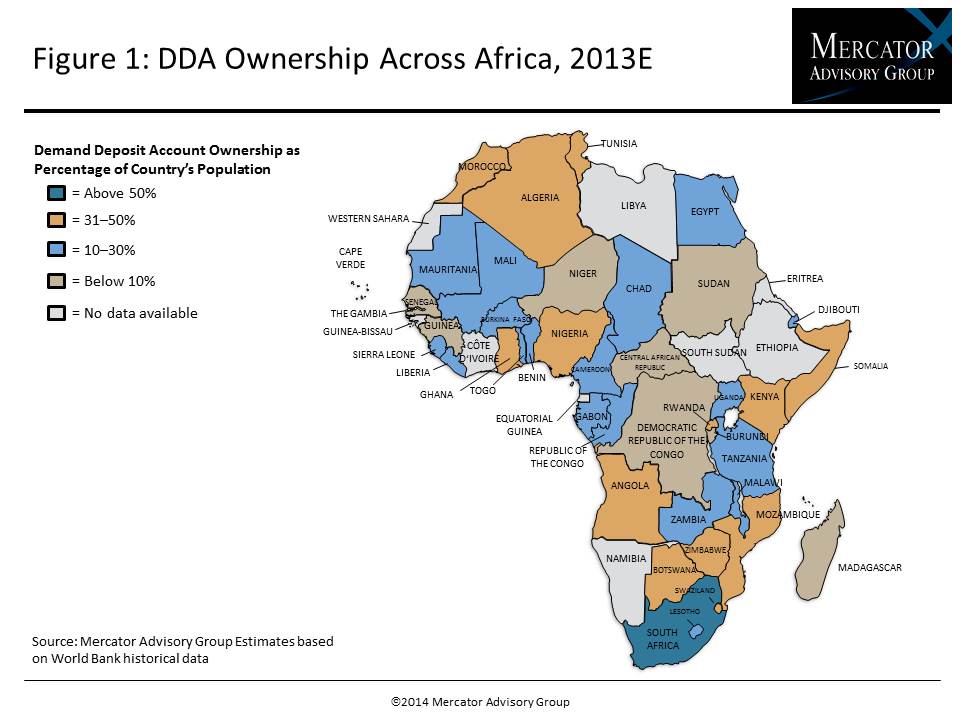

One of the exhibits included in this report:

Highlights of the report include:

- Overview of DDA account, debit card, and credit card penetration as well as branch, ATM, and mobile payment usage across selected markets in Africa

- An examination of emerging trends and developments across Africa in relation to payment card issuing, branch innovation, mobile payment adoption, among others.

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world