Overview

Boston, MA

December 2003

Advanced Functionality ATMs: A New Presence For The 21st Century

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Financial institutions are making investments in the ATM infrastructure to meet stringent security mandates. To improve the return on this investment ATM operators are also evaluating how advanced function ATMs can be used to improve the return on that investment through improved operational efficiency or by enabling the introduction of new products or services, or both. "Advanced Functionality ATMs: A New Presence For The 21st Century" is a resource that:

- Documents the benefits (hard and soft) of each service the advanced functions enable,

- Identifies the key costs and implementation issues involved in deploying each service,

- Investigates the impact on network and ATM operations and on the backend systems and middleware needed to implement the advanced functions.

Advanced functions researched include deposit automation, cash recycling, audio and video processing, speech processing, and how these technologies will be combined, merged, and secured in innovative ways over a converged IP network. Innovative opportunities investigated include the role of the ATM as a wireless hotspot, the utilization of audio and video processing to reduce fraud and detect tampering, and the use of check imaging, audio and video, combined with the high-speed Internet and offshore outsourcing, to validate high value transactions.

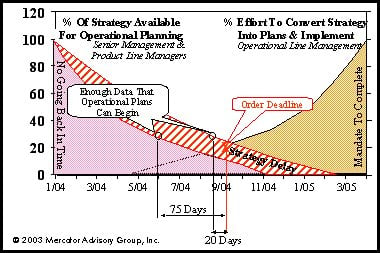

The report also identifies key challenges, and concludes with research that the IT and ATM operations organizations within financial institutions are likely to find themselves in a strategy/implementation gap. Advanced functions greatly increase the effort and complexity involved in defining a business strategy with the detail required by IT and ATM operations to develop a new architecture and then design and order the required network, security, and ATM components. From a business strategy perspective, the features and services enabled by advanced functions requires a consensus from multiple departments that have traditionally been considered autonomous - suggesting that strategy development will be delayed due to new organizational dynamics.

But IT and ATM operations have a fixed end-date defined by the mid-2005 security mandate and will need to create a new IT architecture, network design and security model which can only be solidified when key strategic decisions have been made. IT and ATM operations must be partners in helping senior management refine the strategy, to both assure appropriate design decisions are encapsulated in the stratey and that the cost and effort associated with deployment are used to guide the strategy. Should strategy development slip, or the information needed by IT and ATM operations be missing, then the design and implementation plans will suffer and in a worst case scenario may force bad decisions that financially hurt the institution.

Tim Sloane, Director of the Debit Advisory Service for Mercator Advisory Group and the author of the report recognizes that advanced functions are both a risk and an opportunity;

"Some advanced features are mandated, others will be driven by opportunity or competitive pressure. It is clear that the new services enabled by these advanced functions will fundamentally alter existing business models but there is little information available regarding which services consumers will embrace and which will provide the best return on investment. The financial institution surely finds itself confronting too much opportunity. This report will clarify the cost and risk associated with each opportunity and therefore be an important factor in the decision making process."

The report is 27 pages long and contains 13 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world